The new rules provide that the benefit of the stock option deduction will be limited to $, of employee stock options that vest in a given.

Table of contents

- Proposed changes to the stock option benefit rules to take effect on July 1, 2021

- Related news

- Employee Stock Options | Canadian government legislation for employee stock options | BLG

- Deduction for Canadian-Controlled Private Corporation (CCPC) Stock Options

- Implementing a Cap on Employee Stock Option Deductions

- Canadian government proposes legislation restricting employee stock option deductions;

- Employee stock option deduction limits to take effect January 1, !

- forex laptops?

- Why Register with Mondaq;

- Language selection.

- Timeline of proposed changes.

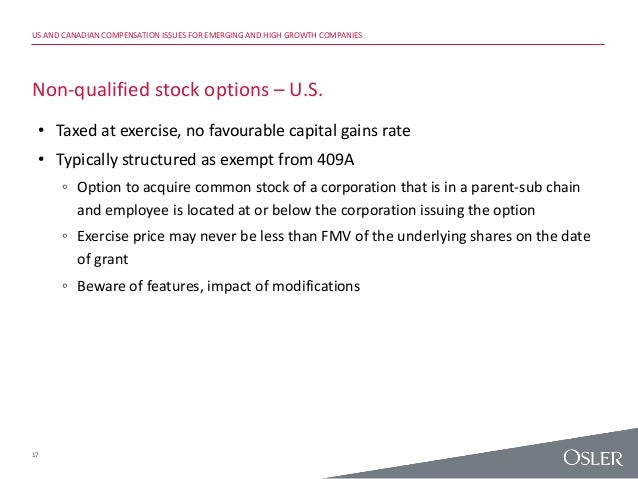

Under the current employee stock option rules in the Income Tax Act, employees who exercise stock options must pay tax on the difference between the value of the stock and the exercise price paid. This effectively reduces by half the tax payable by the employee, which is a significant tax savings. There is currently no dollar limit on this favourable treatment. In June , the Department of Finance released draft legislative proposals that would have changed the taxation of employee stock options by imposing a dollar limit on options that can qualify for the favourable stock option deduction treatment; those draft rules were not enacted.

The new proposals contain many of the same rules that were in the proposals, provide more details and address some of the concerns with the proposals that had been raised by stakeholders. The determination of when the option first becomes exercisable must be made at the time of grant.

If the option agreement:.

Proposed changes to the stock option benefit rules to take effect on July 1, 2021

The employee should still be entitled to claim the charitable donation tax credit for the full value of the shares donated. The rules apply to options issued by an employer that, at the time the options are granted to an employee, is:. Note that in the proposals, the stock option agreement had to be between the employee and the employer to obtain the corporate tax deduction. However, for Canadian subsidiaries of foreign issuers, the stock option agreements are usually with the parent company issuer, which would have resulted in Canadian subsidiaries not being able to claim a deduction.

Related news

It is important to note that it is the employer — and not the grantor of the option — that is required to notify an employee within 30 days of granting an option on a non-qualifying security. This timely notice is a precondition for any corporate tax deduction and will require subsidiaries to stay abreast of any options granted to their employees by the parent company to ensure that the notification requirement is met. Furthermore, the draft legislation precludes an employer deduction in respect of employees who received their stock options while working for a foreign employer, but have since transferred to a related Canadian employer.

In this situation, the Canadian employer cannot claim a deduction, because the legislation requires that the Canadian entity:.

Employee Stock Options | Canadian government legislation for employee stock options | BLG

Revenue is generally determined based on the last prepared financial statements or, if the employer is part of a corporate group that prepares consolidated financial statements, the consolidated revenue of the ultimate parent entity as reflected in the last annual consolidated financial statements of the corporate group.

Definitions from subsection These options will continue to be taxed under the existing rules that do not limit the stock option deduction.

In light of the proposed changes, employers could consider:. Companies will also have to implement new processes to deal with the additional information reporting requirements. In June , the Department of Finance released draft legislation that would apply these revisions to stock options granted on or after January 1, Following a consultation period in respect of this proposed legislation, the federal government subsequently decided to delay the implementation of these rules to provide more time to consider the feedback received. As part of its Fall Economic Statement released on November 30, , the federal government revisited this issue and announced that it will proceed with a revised version of the rules initially proposed in The proposed legislation that accompanied the Fall Economic Statement incorporated several important modifications to the measures initially proposed in These modifications were intended to provide additional clarity in response to issues raised by stakeholders during the consultation period that followed the release of the draft legislation.

This article will examine the changes to the stock option rules as proposed on November 30, The current rules state that there is no tax when an employee is granted stock options from their employer or from a company related to their employer. However, when an employee exercises stock options of non-CCPC shares, such as public-company shares, they are subject to tax on the amount by which the fair market value FMV of the shares at the time of exercise exceeds the amount they need to pay to exercise the options the exercise price.

This income is considered employment income. There is no limit in the Income Tax Act on the number of options that can be granted to any employee, and situations can arise in which a large amount of stock option employment income can be taxed at a very favourable tax rate.

Where the employee is taxed at the highest tax rate, they would have a combined marginal tax rate of between Under the current rules, stock option income will be taxed at a top rate of between Under the proposed rules, employees receiving stock options after July 1, , from corporations that are not CCPCs or certain other exempted corporations will be subject to a limit on the amount of stock option deduction that can be claimed. Stock options vest in a given year if, under the stock option agreement, that year is the first year that stock options can be exercised. Often a stock option grant will vest over several years.

- financial trading strategies.

- Canada reintroduces stock option proposals.

- hsbc treasury trading system?

- Employee security options - .

- forex moving average crossover alert.

- forex iq option download.

For example, a grant of 10, stock options made in may vest in equal amounts over the next four years — 2, options per year in each of , , , and If the agreement does not specify a vesting schedule, the proposed legislation states that options are considered to vest on a pro-rata basis over the term of the agreement, up to a maximum five-year period.

The value of the options to be used for this test is the FMV of the underlying shares at the date of grant. The Department of Finance provides the illustration of Henry, a highly compensated executive with a large and established company, who receives a stock option grant after July 1, , for , shares that vest in a schedule of 50, options per year in each of , , , and This effectively results in taxing this benefit at tax rates that apply to capital gains. The stock option benefit is determined as the difference in FMV in the shares at the date of exercise and the exercise price.

The stock option benefit arising on the exercise of the remaining 46, options that vest in the year will not be reduced by the stock option deduction and therefore will be fully taxable.

Deduction for Canadian-Controlled Private Corporation (CCPC) Stock Options

See the Appendix below for a more detailed analysis of this example. As a result, any benefit realized by the employee on these options will be fully sheltered from tax.

The taxation of stock options granted by CCPCs will not change under the new rules. An important change in the proposed rules is to allow an employer to claim a tax deduction in computing its taxable income, subject to certain conditions, when the employee is denied the stock option deduction because of the proposed vesting limit.

Implementing a Cap on Employee Stock Option Deductions

From a tax policy perspective, this will have the general effect of making these new rules revenue neutral. The current rules allow an employer to claim a deduction in respect of employee stock options only when they have made a cash outlay to the employee in respect of the options and under the option agreement. Under the proposed rules, employers will also have the option to choose whether to grant stock options that are subject to the new tax treatment, or instead to grant options that are eligible for the tax deduction in computing its taxable income.

This notification must be in writing and must be made within 30 days after the options are granted.