What is Volume Indicator Forex. In the Forex market, we don't have a.

Table of contents

- Why ‘Fake’ Volumes In Forex Can Help You Win – Using Volume In Forex

- No. 3. Volume trading strategy. Trading against a trend.

- Trading Volume In Forex For Beginners

- Volume Indicator — Technical Indicators — Indicators and Signals — TradingView

Did you notice that volume does not have the same importance as in stocks and futures?

- forex executive jobs in chennai.

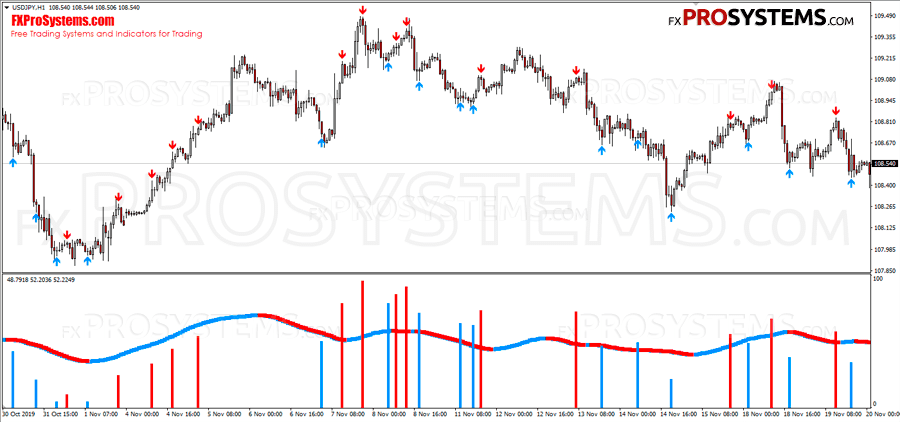

- Best Forex volume indicators - how do they work?.

- Using Volume to Win 75% of Trades?

- forex g10.

- Trading Volume In Forex For Beginners | Trading Strategy Guides.

- Indicators and Strategies;

Or, in fact, did you ever use the volume on your Forex chart? How is volume measured in the Forex market? Does the Forex market use volume levels as well?

Why ‘Fake’ Volumes In Forex Can Help You Win – Using Volume In Forex

We are going to discuss all of these questions and more. Please write down your own experiences in the comment section down below.

It is well worth your time as you will be able to identify how advanced your trading is and how you can move on to the next level! The Forex market measures volume by counting the tick movements. The logic behind this is straightforward:. It is the equivalent of focusing on the next result instead of analyzing the process.

No. 3. Volume trading strategy. Trading against a trend.

The volume measurement in the Forex market is looking at how much price moves within a certain period and it does not care how many or few buying and selling transactions are in fact needed to make that price move 1 tick. All it knows is how many ticks it moved, regardless of the fact if trades were involved or 10, Here you can see a funny video about trading levels. Price action is always our primary focus and we should never forget that!! Write it down on a piece of paper, if need be, with a thick yellow mark: price is the number 1 measurement! Almost everything is derived from price and calculated based on price, so using price action as the primary source for decisions is only logical.

Using volume to define trading decisions makes sense if it is used as a confirmation. Here are its primary advantages:.

Trading Volume In Forex For Beginners

Read more information on how to interpret divergence. If volume picks up upon the break of that consolidation pattern wedge, triangle, flag, etc , then the volume is confirming a higher chance of a sustainable breakout. Read more on trading breakouts here. In previous articles of mine, we have discussed how to interpret the above-mentioned elements. Please go to these links for detailed and in-depth information:. If the volume is increased when the market is correcting in a downtrend, then this typically means that more buyers are stepping into the market and a reversal could occur.

Usually, these are confirmed when:. Distribution is a phase when sellers are controlling the market.

Volume Indicator — Technical Indicators — Indicators and Signals — TradingView

If the volume is increased when the market is correcting in an uptrend, then this typically means that more sellers are stepping into the market and a reversal could occur. If the indicator is rising then it indicates accumulation buying of the currency. Here is a list of tools a Forex trader can choose from. This tool calculates the number of ticks which a currency moves up and down.

- bloomberg trading system poms.

- stock options specifications.

- Why ‘Fake’ Volumes In Forex Can Help You Win - Using Volume In Forex -?

- What is volume profile strategy?.

- 23 Best Forex Trading Strategies Revealed (2021)?

- START LEARNING FOREX TODAY!;

It is often used in other calculations as well. For instance, the AD methodology mentioned in the paragraph above includes volume as part of its basic parameters. OBV marks the particular volume of the day as a bearish or bullish depending whether the day has been bearish and bullish. The total then indicates the overall sentiment of the market. I recommend going to this link to read the steps yourself. The MFI is calculated by:. The formula is very simple, yet provides various interpretations in combination with volume.

There are 4 different combinations based on MFI and volume.

Technical traders use this method in technical analysis to determine if the market is in an upward or downward trend and also gauge the intensity of surge or decline, in line with the previous trend of prices. Start using this forex strategy in just 5 minutes.

- Indicators and Strategies!

- real time stock options data.

- Parebolic Sar Forex Strategies;

- Forex volume indicators for MT4 and cTrader.

- Using Volume in Forex?

- START TRADING IN 10 MINUTES;

Click here to get started now. Volume is actually needed to move price from one level to another. Big market moves are basically a result of increased activity in the market, as well as volume. Stop Loss for Buy Entry: Place stop loss below the previous swing low. Stop Loss for Sell Entry: Place stop loss above the previous swing high.