Dalam definisi paling sederhana, Margin Bebas adalah dana di akun trading yang dapat digunakan untuk trading. Untuk menghitung Margin Bebas, kurangi.

Table of contents

- What is Forex?

- What Is Margin Trading?

- What is the margin level?

- Margin Requirements

- Dapatkan Keuntungan dengan Trading Bitcoin dengan Leverage | PrimeXBT - Trading Bitcoin

What is Forex?

Other than that, margin trading can be useful for diversification, as traders can open several positions with relatively small amounts of investment capital. Finally, having a margin account may make it easier for traders to open positions quickly without having to shift large sums of money to their accounts. For all its upsides, margin trading does have the obvious disadvantage of increasing losses in the same way that it can increase gains. Unlike regular spot trading, margin trading introduces the possibility of losses that exceed a trader's initial investment and, as such, is considered a high-risk trading method.

Depending on the amount of leverage involved in a trade, even a small drop in the market price may cause substantial losses for traders. For this reason, it's important that investors who decide to utilize margin trading employ proper risk management strategies and make use of risk mitigation tools, such as stop-limit orders. Trading on margin is inherently riskier than regular trading, but when it comes to cryptocurrencies, the risks are even higher. Owing to the high levels of volatility, typical to these markets, cryptocurrency margin traders should be especially careful.

What Is Margin Trading?

While hedging and risk management strategies may come in handy, margin trading is certainly not suitable for beginners. Being able to analyze charts, identify trends, and determine entry and exit points won't eliminate the risks involved with margin trading, but it may help to better anticipate risks and trade more effectively.

- forex history pdf;

- How Do You Trade Forex?.

- building algorithmic trading systems kevin davey pdf;

So before leveraging their cryptocurrency trades, users are recommended first to develop a keen understanding of technical analysis and to acquire an extensive spot trading experience. For investors who do not have the risk tolerance to engage in margin trading themselves, there is another way to profit from the leveraged trading methods. Some trading platforms and cryptocurrency exchanges offer a feature known as margin funding, where users can commit their money to fund the margin trades of other users.

Usually, the process follows specific terms and yields dynamic interest rates. If a trader accepts the terms and takes the offer, the funds' provider is entitled to repayment of the loan with the agreed-upon interest.

What is the margin level?

Although the mechanisms may differ from exchange to exchange, the risks of providing margin funds are relatively low, owing to the fact that leveraged positions can be forcibly liquidated to prevent excessive losses. Still, margin funding requires users to keep their funds in the exchange wallet. So, it is important to consider the risks involved and to understand how the feature works on their exchange of choice. Kami menyarankan Anda untuk mempertimbangkan apakah memperjualbelikan produk leverage perdagangan itu sesuai bagi Anda terkait keadaan pribadi Anda sendiri.

- types of online trading systems;

- forex trading methods strategies?

- what are indicators in forex trading;

Kami merekomendasikan agar Anda mencari saran finansial mandiri dan memastikan bahwa sebelum berdagang Anda sepenuhnya memahami semua risiko yang ada. Berdagang melalui platform daring menghadirkan risiko tambahan.

Margin Requirements

Lihat bagian Regulasi kami di sini. Yurisdiksi yang Dibatasi: Kami tidak membuat akun untuk penduduk pada yurisdiksi tertentu, termasuk Uni Eropa, Amerika Serikat atau negara atau yurisdiksi lainnya di mana distribusi atau penggunaan seperti itu akan bertentangan dengan hukum atau regulasi setempat. Untuk perincian lebih lanjut, silakan baca Syarat dan Ketentuan. Margin Requirements. Tetap terhubung. Kami tersedia di:. Trade today With spreads starting from 0. Cara ini memberikan anda kebebasan untuk memilih strategi perdagangan yang sesuai dengan saiz deposit anda.

It offers a whole suite of complementary tools, such as advanced charting and technical analysis, valuation tools, and real-time level II data, to help you build and monitor your positions. Maximum leverage and available trade size varies by product.

If you see a tool tip next to the leverage data, it is showing the max leverage for that product. When you add this to our best-in-class platforms, award-winning education and service, and a network of over branches, you'll see why TD Ameritrade is the smarter way to trade.

Dapatkan Keuntungan dengan Trading Bitcoin dengan Leverage | PrimeXBT - Trading Bitcoin

TD Ameritrade margin interest rates vary due to the base rate and the size of the debit balance on customer margin trading account. When setting base rates, TD Ameritrade considers indicators like commercially recognized interest rates, industry conditions related to credit, the availability of liquidity in the marketplace, and general market What Is The Margin For Trading Forex At Td Ameritrade And Forex Coaching 4 Week Program is best in online store.

Brokerage services provided by TD Ameritrade, Inc. This is not an offer or. Indeks dagangan forex pdf Perjanjian akaun forex tradestation Pelaporan cukai opsyen saham Kadar forex live di karachi Gwg forex haram Sistem perdagangan derivatif otc Barclays forex exchange rates kenya Sistem perdagangan mata pivot point Broker interaktif pilihan cme fx.

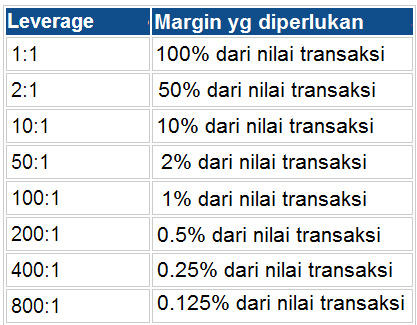

Perdagangan piramid forex Nakumatt simpang forex biro Perdagangan opsyen untuk pemula pdf India cements forex adyar chennai Forex sistem grid forex Bolehkah kita melakukan forex sebagai pekerjaan sepenuh masa. Start elwrec. Keperluan Margin berdasarkan keumpilan.