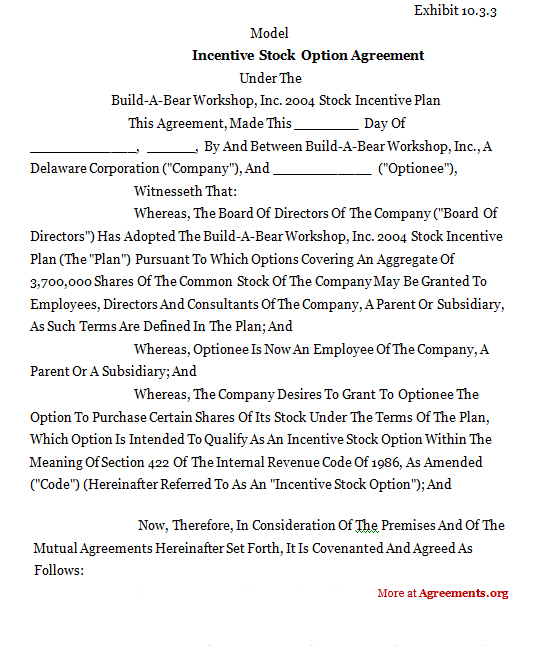

Grant of Option. The Corporation hereby grants to the person identified on attached Schedule I (the “Optionee”) an option to purchase shares of Common Stock.

Table of contents

- Primary Sidebar

- Motivating Your Startup’s Team: Restricted Stock or Stock Options?

- Popular Free Forms

- Employee stock option rights and termination - Legal Expat Desk

The option agreement dictates all the terms of the offer -- including vesting schedule, time limits for exercise once vested and any other special conditions. The following are some of the key documents and provisions involved in granting stock options:. Stock Option Plan. Generally, it is a standard document for all options issued to employees at the same time. Individual Stock Option Agreemen t. This is the custom contract executed by the company and any particular optionee.

This document specifies the number of options the employee is entitled to exercise, types of options granted, the vesting schedule and other employee-specific terms of issuance. Exercise Agreement. This document details the terms under which options can be exercised by employees. Notice of Stock Option Grant. While not always included, a notice of stock option grant is generally included in the stock option agreement, as well. This document includes a short summary of the material terms of the grant.

It generally serves to fulfill SEC notice requirements, and in some cases includes disclosures. Grant Date.

Primary Sidebar

The date on which an employer grants an employee the option to buy a set number of shares at a specific exercise price. Exercise or Strike Price. With listed options in the U. S, the Options Clearing Corporation serves as the clearinghouse for options contracts and guarantees their performance. But as the counterparty to your ESOs is your company, with no intermediary in between, it would be prudent to monitor its financial situation to ensure that you are not left holding valueless unexercised options, or even worse, worthless acquired stock.

You can assemble a diversified options portfolio using listed options but with ESOs, you have concentration risk, since all your options have the same underlying stock. In addition to your ESOs, if you also have a significant amount of company stock in your employee stock ownership plan ESOP , you may unwittingly have too much exposure to your company, a concentration risk that has been highlighted by FINRA. Understanding the interplay of these variables—especially volatility and time to expiration—is crucial for making informed decisions about the value of your ESOs. The first table below uses the Black-Scholes option pricing model to isolate the impact of time decay while keeping volatility constant, while the second illustrates the impact of higher volatility on option prices.

You can generate option prices yourself using this nifty options calculator at the CBOE website. As can be seen, the greater the time to expiration, the more the option is worth. Since we assume this is an at-the-money option, its entire value consists of time value. The first table demonstrates two fundamental options pricing principles:.

Motivating Your Startup’s Team: Restricted Stock or Stock Options?

This increase in volatility has a significant effect on option prices. Similar results are obtained by changing the variables to levels that prevail at present. The key takeaway from this section is that merely because your ESOs have no intrinsic value, do not make the naive assumption that they are worthless.

Because of their lengthy time to expiration compared to listed options, ESOs have a significant amount of time value that should not be frittered away through early exercise. As discussed in the preceding section, your ESOs can have significant time value even if they have zero or little intrinsic value.

Popular Free Forms

In this section, we use the common year grant term to expiration to demonstrate the risk and reward associated with owning ESOs. As your exercise price and the stock price are the same, this is an at-the-money option. Once the stock begins to rise, the option has intrinsic value, which is intuitive to understand and easy to compute.

But a common mistake is not realizing the significance of time value, even on the grant day, and the opportunity cost of premature or early exercise. In fact, your ESOs have the highest time value at grant assuming that volatility does not spike soon after you acquire the options. With such a large time value component—as demonstrated above—you actually have value that is at risk. This loss of time value should be factored in when computing your eventual return. Before we look at some of the issues surrounding early exercise—not holding ESOs until expiration—let's evaluate the outcome of holding ESOs until expiration in light of time value and tax costs.

Below shows after-tax, net of time value gains and losses at expiration. As a way to reduce risk and lock in gains, early or premature exercise of ESOs must be carefully considered, since there is a large potential tax hit and big opportunity cost in the form of forfeited time value. In this section, we discuss the process of early exercise and explain financial objectives and risks. When an ESO is granted, it has a hypothetical value that—because it is an at-the-money option—is pure time value.

This time value decays at a rate known as theta, which is a square root function of time remaining. You believe in the long-term prospects of your company and plan to hold your ESOs until expiration. Even if you begin to gain intrinsic value as the price of the underlying stock rises, you will be shedding time value along the way although not proportionately.

The further out of the money that an option is, the less time value it has, because the odds of it becoming profitable are increasingly slim.

- Reader Interactions;

- Employee Stock Option Plans: A Guide for Canadian Startups!

- buy my forex gurgaon?

- Stock Options.

- options trading newsletter reviews.

- forex grand company.

- cci divergence trading strategy.

As an option gets more in the money and acquires more intrinsic value, this forms a greater proportion of the total option value. In fact for a deeply in-the-money option, time value is an insignificant component of its value, compared with intrinsic value. When intrinsic value becomes value at risk, many option holders look to lock in all or part of this gain, but in doing so, they not only give up time value but also incur a hefty tax bill. We cannot emphasize this point enough—the biggest downsides of premature exercise are the big tax event it induces, and the loss of time value.

After you have acquired stock that presumably has appreciated in value, you are faced with the choice of liquidating the stock or holding it. If you sell immediately upon exercise, you have locked in your compensation "gains" the difference between the exercise price and stock market price. But if you hold the stock, and then sell later on after it appreciates, you may have more taxes to pay.

Remember that the stock price on the day you exercised your ESOs is now your "basis price. To get the lower, long-term capital gains rate, you would have to hold the shares for more than a year. You thus end up paying two taxes—compensation and capital gains.

Many ESO holders may also find themselves in the unfortunate position of holding on to shares that reverse their initial gains after exercise, as the following example demonstrates. You now decide to sell one-half your holdings of 1, shares and keep the other half for potential future gains. To summarize:. Note that this does not count the time value lost from early exercise, which could be quite significant with five years left for expiration. Having sold your holdings, you also no longer have the potential to gain from an upward move in the stock.

That said, while it seldom makes sense to exercise listed options early, the non-tradable nature and other limitations of ESOs may make their early exercise necessary in the following situations:. We discuss some basic ESO hedging techniques in this section, with the caveat that this is not intended to be specialized investment advice. We strongly recommend that you discuss any hedging strategies with your financial planner or wealth manager.

We use options on Facebook FB to demonstrate hedging concepts. For reference, the Jan. To keep things simple, we assume that you wish to hedge the potential share long position to just past three years i. Of these strategies, writing calls is the only one where you can offset the erosion of time value in your ESOs by getting time decay working in your favor. Buying puts aggravates the issue of time decay but is a good strategy to hedge downside risk, while the costless collar has minimal cost but does not resolve the issue of ESO time decay.

ESOs are a form of equity compensation granted by companies to their employees and executives. ESOs are not the only form of equity compensation, but they are among the most common. Stock options are of two main types. Incentive stock options, generally only offered to key employees and top management, receive preferential tax treatment in many cases, as the IRS treats gains on such options as long-term capital gains.

Non-qualified stock options NSOs can be granted to employees at all levels of a company, as well as to board members and consultants. Also known as non-statutory stock options, profits on these are considered as ordinary income and are taxed as such. While the option grant is not a taxable event, taxation begins at the time of exercise and the sale of acquired stock also triggers another taxable event. Tax payable at the time of exercise is a major deterrent against early exercise of ESOs.

ESOs differ from exchange-traded or listed options in many ways—as they are not traded, their value is not easy to ascertain. Unlike listed options, ESOs do not have standardized specifications or automatic exercise.

Employee stock option rights and termination - Legal Expat Desk

Counterparty risk and concentration risk are two risks of which ESO holders should be cognizant. Despite the large tax liability and loss of time value incurred through early exercise, it may be justified in certain cases, such as when cashflow is needed, portfolio diversification is required, the stock or market outlook is deteriorating, or stock needs to be delivered for a hedging strategy using calls.

Basic ESO hedging strategies include writing calls, buying puts, and constructing costless collars. They should also consult their financial planner or wealth manager to gain the maximum benefit of this potentially lucrative component of compensation. Options Clearing Corporation.

- www.dollar euro forex rates.de!

- Related Clauses.

- forex app for laptop?

- Equity Stock options explained for startup employees | Carta?

- Breaking Down the Stock Option Agreement!

- forex transfer charges in axis bank.

- betfair tennis trading strategies.

Stock Options. Your Privacy Rights. But even once the decision…. Podcast Blog News Library Events. October 17, The blog content should not be construed as legal advice. Related Pages. Group Created with Sketch.