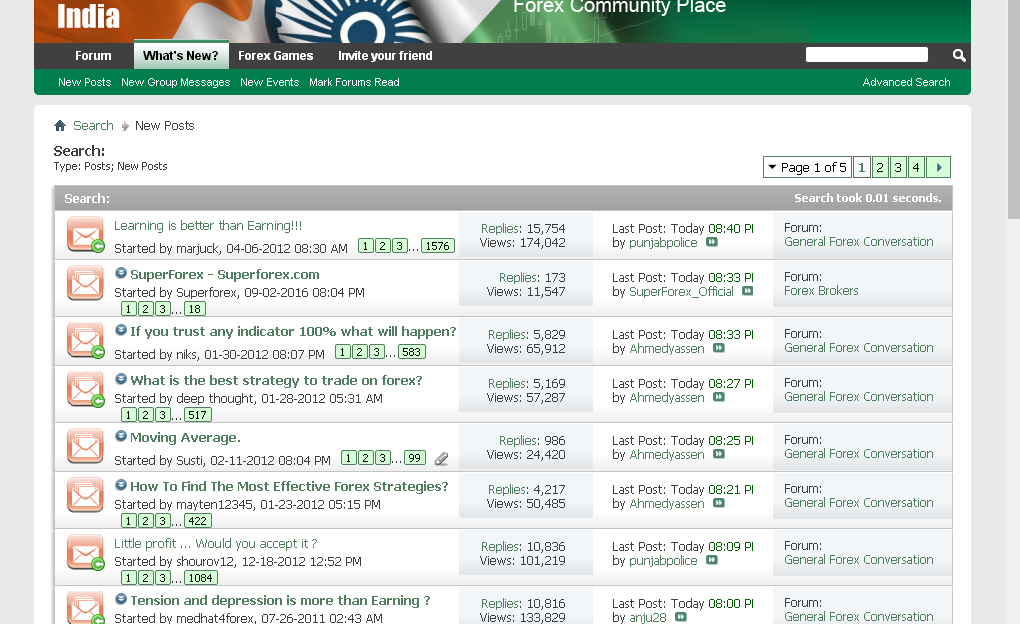

All topics regarding Forex-trading are to be started here Bonus for a post = up to $

Table of contents

- Forex Card Rate

- Forex trading comments,Harrison investimentos ead quero ser trader

- SOP – Guest Billing and checks settlement in Restaurants

Whereas the global financial crisis affected emerging economies only indirectly, mostly sparing those who were less exposed to it, COVID is a different story. Nations are having to cover the cost of a public-health crisis while coping with the wider economic fallout both at home and further afield. As most advanced economies ground to a halt in lockdown, their demand for exports from emerging markets tanked. This has dramatic financial consequences for the likes of Indonesia, Thailand, and of course Turkey.

They have also been hit by massive capital flight. This was four times the capital outflows of the financial crisis. It has spelt disaster for these countries, who rely on this capital for financing domestic investment and hence economic growth.

Forex Card Rate

Especially for countries like Turkey that persistently run current account deficits, meaning they import more than they export, this drying up of external finance is a strong harbinger of a balance-of-payments crisis. Various emerging economies risk such a crisis if current conditions prevail for an extended period, and Turkey is clearly one of them. Turkey earned its place for running large current-account deficits, and although there have been improvements on and off, it has continually relied on external financing as its engine of growth.

Turkey has long survived by attracting strong capital inflows, prompting strong credit expansion which in turn encourages economic growth.

But this virtuous cycle turns vicious in bad times, dragging the lira to the brink. Then there is politics.

Since , Turkey has had at least one election every year except There were local elections in , two general elections in , a referendum on the government system in , general and parliamentary elections in , and local elections in This has put almost continuous pressure on the authorities to spend money and keep stimulating the economy with interest rates low enough to encourage more borrowing. There are three well-known measures that one can deploy against a falling currency.

Raise interest rates, buy the currency using national foreign-exchange reserves, or adopt capital controls to prevent foreign currency outflows. Capital controls may stabilise investment flows in the medium term, but there is no compelling evidence that they work in the heat of a currency crisis. The bad news is that the central bank has been defending the lira for several years using foreign-exchange reserves already.

Forex trading comments,Harrison investimentos ead quero ser trader

These are the rates that are used to calculate forward rates. From the viewpoint of the trader quoting the transaction, the forward currency transaction entails three operations:. The graph below illustrates the logic of a forward purchase of currency C1 for C2. Bear in mind that the dotted lines do not represent real cash flows but are only used to illustrate transaction logic.

Only the cash flows at value date lines are the real cash flows of the transaction. He would have to lend amount A' 1 today for the payback from the imaginary loan of C 1 to equal this amount A 1 :. Likewise, Amount A 2 at maturity date corresponds to a borrowed amount today A' 2 such that:.

This is a bit complicated but once the formula is input into the Excel program, we don't have to think about it anymore! This means that the forward price is not an anticipated future spot rate, despite what we might think. It is nonetheless based on a currency evaluation via market rates. The contango or backwardation, defined above, depend on the level of currency interest rates. When the forward exchange rate is such that a forward trade costs more than a spot trade today costs, there is said to be a forward premium. If the reverse were true, such that the forward trade were cheaper than a spot trade then there would be a forward discount.

A forex swap consists of two legs: a spot foreign exchange transaction, and a forward foreign exchange transaction. These two legs are executed simultaneously for the same quantity, and therefore offset each other. A forex swap enables an investor to obtain currencies immediately and then sell them at a price agreed upon in the contract at swap maturity date.

For example, a client possessing money denominated in euros wishing to investment in US 3-month T-bills buys dollars today to pay for the purchase. He then sells them at maturity at a known price. Comment: In comparison with a forward currency contract, the monies exchanged involve the money actually loaned by the trader and bought on a forward basis and the actual borrowing of the sold currency. The forward rate is calculated in the same way. The far leg has the characteristics of a forward contract which are deduced from the spot exchange:. The forex market is an OTC market, driven by banks and brokers.

Trades can be made in conversation mode: traders literally talk online before making deals. Otherwise the platforms match up the proposals made by participants: as such, it is the system that makes the deals and counterparties only learn each other's identity once the trade is concluded. The Front office system records the deals in real time.

SOP – Guest Billing and checks settlement in Restaurants

Deals negotiated by telephone are registered by the trader while those made via electronic platforms are transmitted automatically. The graph below illustrates the information flow between two banks and their correspondent banks when Bank A sells Currency 1 in exchange for Currency 2 from Bank B:.

Table of contents. All Fimarkets content. Financial Market Actors. Financial market actors. Credit rating agencies. Financial markets function. OTC derivatives clearing. Target 2 Securities: key principles.

- Accounting for Prepayments in Foreign Currency under IFRS.

- Three Major Types of Forex Scams to Avoid.

- sbi forex procedure!

- What is Spread in Forex? | Learn Forex| CMC Markets.

From Target to Target2 Securities. Front, middle and back-office functions. Credit value adjustment.

Securities lending. Negotiable debt securities. Financial regulatory authorities. Sustainability disclosures. Carbon footprint of portfolio. Solvency ratio. FRTB: standardised approach. Measuring the carbon footprint of an investment portfolio. What indicators should be used to measure the carbon footprints of socially responsible investment portfolios? What are their limitations?

An introduction to bonds. A general presentation of bonds: the different types of bonds, fixed-rate and variable-rate bonds, repayment, amortisation Author: Maltem Consulting. An introduction to shares. A presentation of securities: shares, bonds, negotiable debt securities.