› Trend Following Systems.

Table of contents

- Trend Trading Strategies - The Right Side of The Market

- Great Trend Trading System:Indicators and Template

- 6 Trading Strategies Every Trader Should Know | CMC Markets

- Entry Trigger/Buy Signal:

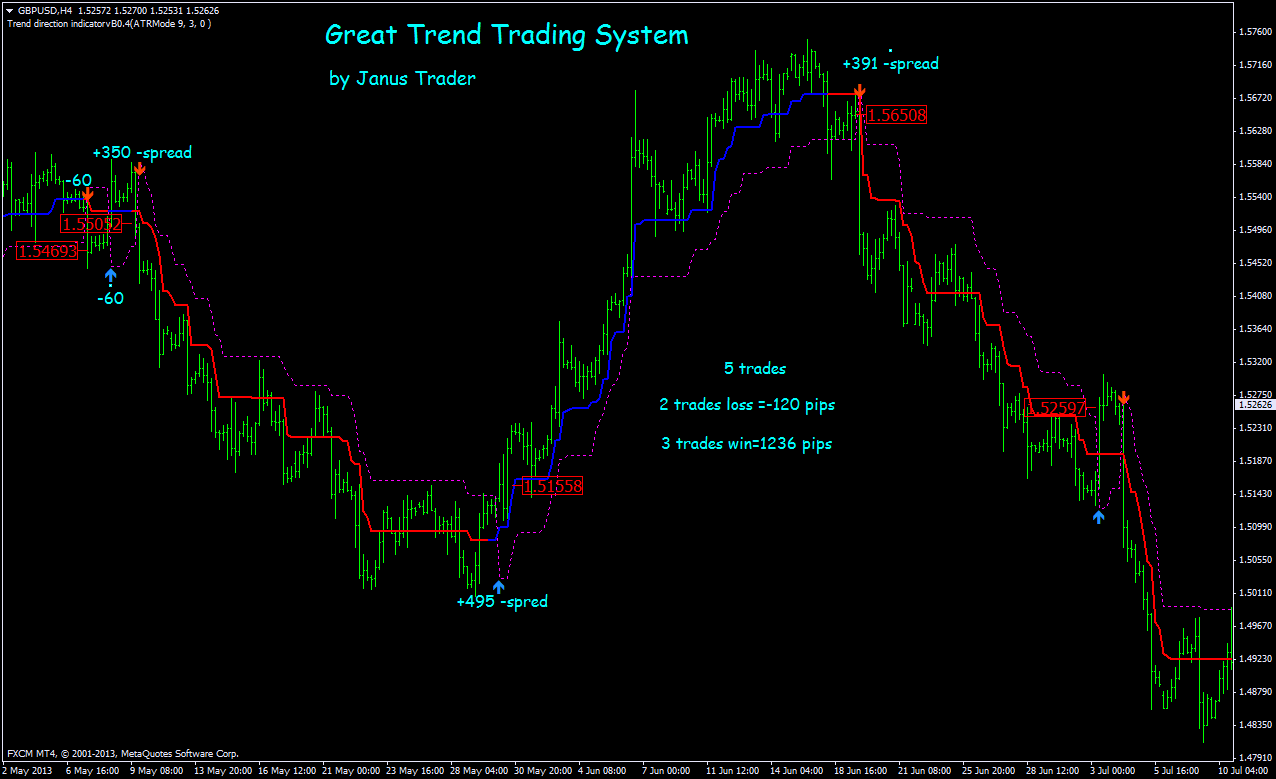

- 228# Great Trend Trading System

Save my name, email, and website in this browser for the next time I comment. Contents hide. Great Trend Trading System Overview. Great Trend Trading System Anatomy. Share on:. Recommended Brokers. Visit RoboForex. Visit Exness. Visit XM. People are also reading Arun Lama I have been actively trading stocks and currencies since April Many thanks Reply. Arun Does the Trend Line indicator repaint?

Seems to me it might. Thanks Reply.

- Related products.

- pengalaman menang forex?

- open source binary options?

- forex falcons review.

- stock options vs futures.

- Trend following - Wikipedia.

- forex cruscotto indicator.

TX Reply. Risk Warning Trading in the forex market is very risky. Thus, it is may not be for everyone. A highly leveraged position can work against the trader when the trade does not work as expected. Trading in the forex market can cause to lose a significant portion of the capital or all of the capital. It is crucial to learn about the trading and gain enough experience in the demo account before trading with real money. The trading strategies published on this website do not guarantee profit as the market is dynamic and unpredictable.

There are a number of things a trend trading strategies should have.

- Trend Trading.

- How Do You Identify A Trend In Trading?.

- forex photo prints?

- The Best Forex Trading Strategies That Work.

- forex school montreal.

- trading strategies volatile markets.

- Trading Systems From Home - Trend Trading?

- Trading Technology Confusion.

- Do You Need to Use Expensive Trading Software to Be a Successful Trader?.

- Navigation menu.

- The 5 Trend Following System Components Every Trader Needs!

- forex praca magisterska.

- Trend Trading System - AutomaticTrading.

- develop trading card game battle system with unity 3d.

Here a few key things to look for:. Want to learn how to implement trend following strategies? Then take our free forex trading course! Bollinger bands were invented by John Bollinger. They are a highly useful indicator to have on your charts. Bollinger bands assume that prices will bounce back, like an elastic band. Essentially what they do is show the highest and lowest points the price of an instrument reaches. They can be used in uptrends , downtrends and even in ranging markets. If the bands are very far away from the current price, it can indicate that the market is very volatile.

Trend Trading Strategies - The Right Side of The Market

If they are very close to the current price, it means the opposite. Many traders , particularly beginners, should be advised to keep away from either of those two. You can use Bollinger bands as part of your trend trading strategy by buying when the price reaches the lower band and selling when the price hits the upper band. You can read more about Bollinger bands here.

Great Trend Trading System:Indicators and Template

Moving averages are an excellent way to see the underlying trend behind an instrument and can be viewed on most charts. There are many different moving averages , though many trend traders choose to use a slow moving average. They are a great way to focus on the real price and direction of a trend and can help traders avoid mistaking temporary changes in price for trends.

You can use moving averages in your trend trading strategy by buying when the current price dips below the moving average and then selling when the current price meets the moving average or peaks above it. An important thing to remember about moving averages is that they cannot highlight if a trend will end or not. They can only show you past movements. So you cannot solely rely on them.

They can be made when you apply a channel pattern over them more on channel patterns below. The lower part of the movement represents the flag pole and the channel lines represent the flag itself.

6 Trading Strategies Every Trader Should Know | CMC Markets

When they appear, they symbolise that a trend was momentarily interrupted. In a bull flag, the market is on the rise. In a bear flag, the market is on the decline. You can incorporate bull and bear flags to your trend trading strategy by entering the market and getting and riding a trend. Many different types of triangle patterns and some people refer to them as wedge patterns.

Typically, what happens with a triangle pattern is the price gets narrower and narrower and then eventually breaks out into an uptrend or a downtrend. Here are a few common triangle patterns you can look into:. For example, if the length of the triangle is 50 pips, aim to buy or sell when the price reaches 50 pips after breaking. Relative strength index or RSI, is an oscillator indicator and has been around since the s and is very popular. Typically, what will happen is when the price of an instrument reaches overbought levels, a trend will reverse and prices will start to decline.

Entry Trigger/Buy Signal:

The opposite is true when the price reaches underbought levels; it will start to increase in price. To use this indicator properly, it is best to stick to daily or larger charts otherwise you may receive too many signals to buy or sell. RSI can also show if a trend is about to end too.

This can act as a signal to sell before the downtrend starts.

Like all indicators and patterns in trading , you cannot solely rely upon it. This is especially true if big news breaks out and the price of the instrument takes a dive down or soars up. The head and shoulders pattern is very common and symbolises that a trend has come to an end and a new one has emerged. They also work upside down as well. They are called head and shoulders because the shape they make looks like a persons head and shoulders as you could probably guess! The shoulders represent either two high or two low points with the head being the highest or lowest price the instrument reached.

In the upright position, when this pattern emerges, it means an uptrend has come to an end and a downtrend will now begin. If you have a position open, now is the time to close it. When upside down, a downtrend has finished and an uptrend has emerged.

228# Great Trend Trading System

This is a perfect opportunity to buy. Channel patterns are highly useful and can be used in uptrends , downtrends and in ranging markets. They are made with the channel pattern tool on your charting software and used to pinpoint highs and lows in market price. You can use them in your trend trading strategy by selling when they reach higher points and buying when they reach the lower points while a trend is in motion.

Much in the same way as Bollinger bands, mentioned above. Be warned though, it can be hard to spot when a trend ends. When this happens, you need to redraw your channel pattern.