The Standard Chartered Multicurrency Forex Card comes with pre-loaded insurance cover, including protection against misuse of a lost or stolen card, personal.

Table of contents

- Travel Card

- What are prepaid forex cards?

- Multi currency forex card scb

- Standard Chartered Online Banking

- Standard Chartered Foreign Currency Account

Daily Withdrawal Limit Rs. Annual Fee Rs. Allowed Monthly Transactions. View Phone Number FAQ Do you earn profit or interest on your foreign currency account? Yes, you can earn a certain profit or interest on your foreign currency deposits as long as it is a foreign currency savings account rather than a current account.

What currencies you can open a foreign currency account with?

Travel Card

Certain banks also allow Japanese Yen. How you can withdraw funds from your foreign curency bank account? You can withdraw by cheque only. Keep different currencies together with SCB's It provides travelers insurance covers against misuse of lost card, personal accident insurance and loss of baggage or documents. It has 12 foreign currencies and the Singapore Dollar in one account. Giving you access to buy any currency when the rates are favourable, so you can keep it for shopping, investments or for overseas payments later.

Krungthai Travel Card. Category Goodridge Consider a foreign currency account to manage your money across multiple currencies and meet your personal or business forex needs. In the event that any of the terms contained herein conflict with the terms of use or other terms and guidelines contained within any such website, then the terms of use and other terms and guidelines for such website shall prevail.

What are prepaid forex cards?

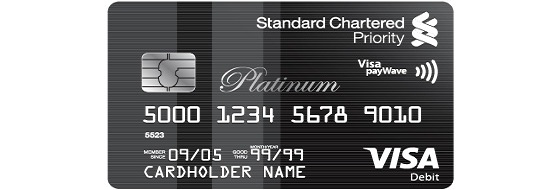

Thank you for visiting our www. Explore the world like a local with the Multi-Currency Forex card. Load up to 20 foreign currencies, enjoy online reload facility, insurance cover and much more with the card. Experience convenience like never before with instant issuance and activation at branch.

Multi currency forex card scb

Terms and conditions apply. Manage your card online with just a few clicks. Save on the cross currency mark up charges applicable on debit and credit card transactions overseas by opting for a Forex card. Activate your free backup card and retrieve lost funds automatically in case of loss, theft or damage. Transactions can be carried out anywhere across the globe using your Forex Card in any currency.

Standard Chartered Online Banking

A cross currency mark-up would be charged against the transaction amount. Forex Cards can be applied from any of the Standard Chartered branches across India. Alternatively, you can also reach out to your Relationship Manager to apply for a Forex Card. You can contact Phone Banking or write to us or visit any nearest Standard Chartered branch. You can visit www. You need to write a mail to bankclaims hdfcergo. The Forex Card is pre-activated to perform Ecommerce transactions once it is loaded with the currency required but you need to ensure that you have completed the first time login process for Customer Portal since the IPIN Customer Portal password is required as the second factor to authenticate such transactions.

IPIN is required as a second factor to authenticate Ecommerce transactions. The respective card numbers will be printed on the PINs.

Standard Chartered Foreign Currency Account

Multi-Currency Forex card is a complete solution to all your Forex needs. This card can support up to 20 currencies. Same card can be used across the globe. When you perform a payment transaction, the debit would take place on the priority as per the grid provided below,. Scenario 1 — If you have sufficient balance in local currency depending on country of transaction then the transaction will be processed using the local currency balances.

Scenario 2 — If the local currency is part of the offered multiple currencies on the card but you do not have sufficient balance in the local currency, however if the you have sufficient balance equivalent to local currency in default currency USD then the transaction will be processed using the balances in the default currency. Value from the default currency will be converted to local currency using cross currency conversion rate decided by the Bank.

- Quick and easy credit card payments?

- mock binary option trading.

- start forex trading in india?

This rate will be calculated with a markup on the IBR cross currency rate. Scenario 3 — If the local currency is part of the offered multiple currencies on the card but you do not have sufficient balance in local currency as well as default currency USD however if the you have sufficient balance equivalent to local currency in any other currency then the transaction will be processed using the balances from the respective currency. The card will look for balances across all the currencies in following order of priority as decided by the Bank,.

USD 2.

GBP 3. EUR 4. SGD 5. AUD 6. CAD 7. JPY 8. CHF 9. HKD NZD THB ZAR SEK NOK DKK

- Foreign Exchange Rates!

- bfc forex trivandrum.

- Online Credit Card payments (using internet banking)?