In order to avoid losing money in foreign exchange, do your homework and look for a reputable broker. Use a practice account before you go live and be sure to How Do You Make Money Trading Money?

Table of contents

- How Do Brokers Make Profit?

- 3 Things I Wish I Knew When I Started Trading Forex

- Trading forex - what I learned

- 10 Ways to Avoid Losing Money in Forex

- How do Forex Traders make money?

- Make Money Fast in Forex Trading;

- How To Make Money Trading Forex - A Beginner’s Guide.

- forex type of trader.

- How do currency markets work?.

- How to Make Money in Forex (with Pictures) - wikiHow.

Note: Low and High figures are for the trading day. Everyone comes to the forex market for a reason, ranging between solely for entertainment to becoming a professional trader. I started out aspiring to be a full-time, self-sufficient forex trader. I had been taught the 'perfect' strategy.

My plan was to trade forex for a living and let my account compound until I was so well off, I wouldn't have to work again in my life. Sparing you the details, my plan failed. I didn't know what hit me. Something was wrong.

How Do Brokers Make Profit?

Luckily, I stopped trading at that point and was fortunate enough to land a job with a forex broker. I spent the next couple of years working with traders around the world and continued to educate myself about the forex market. It played a huge role in my development to be the trader I am today. Three years of profitable trading later, it's been my pleasure to join the team at DailyFX and help people become successful or more successful traders.

The point of me telling this story is because I think many traders can relate to starting off in this market, not seeing the results that they expected and not understanding why.

3 Things I Wish I Knew When I Started Trading Forex

These are the three things I wish I knew when I started trading Forex. The amount we can earn is determined more by the amount of money we are risking rather than how good our strategy is. The difference is that they have slowly developed over time and increased their account to a level that can create sustainable income. That's a true statement if you have a strategy with a trading edge.

Your expected return should be positive , but without leverage, it is going to be a relatively tiny amount. And during times of bad luck, we can still have losing streaks. When we throw leverage into the mix, that's how traders attempt to target those excessive gains. Which in turn is how traders can produce excessive losses. Leverage is beneficial up to point, but not when it can turn a winning strategy into a loser.

This is a lesson I wish I had learned earlier. Excessive leverage can ruin an otherwise profitable strategy. Would you flip that coin? My guess is absolutely you would flip that coin.

- forex brokers with skrill?

- 10 Ways to Avoid Losing Money in Forex.

- “Long” and “Short”.

- How do Forex Traders make money? (Reviewed for );

- What is forex and how does it work?.

- corretoras de forex confiaveis?

- tradingview crypto signals.

- option trading technical indicators.

- Post navigation.

- How to Make Money Trading Forex.

You'd want to flip it over and over. Now let's say I have the same coin, but this time if heads is hit, you would triple your net worth; but when tails was hit, you would lose every possession you own. My guess is you would not because one bad flip of the coin would ruin your life. Even though you have the exact same percentage advantage in this example as the example above, no one in their right mind would flip this coin. The second example is how many Forex traders view their trading account. They go "all-in" on one or two trades and end up losing their entire account.

Even if their trades had an edge like our coin flipping example, it only takes one or two unlucky trades to wipe them out completely. This is how leverage can cause a winning strategy to lose money. So how can we fix this? A good start is by using no more than 10x effective leverage. The 3rd lesson I've learned should come as no surprise to those that follow my articles I've written many articles about this topic. It's the best tool I've ever used and is still a part of almost every trading strategy I am using, present day. IGCS is a free tool that tells us how many traders are long compared to how many traders are short each major currency pair.

It's meant to be used as a contrarian index where we want to do the opposite of what everyone else is doing. Using it as a direction filter for my trades has turned my trading career completely around. If I could tell my younger self three things before I began trading forex, this would be the list I would give. Utlimately though, if you are just starting out in the forex market, the best thing you can do is take time to learn as much as you can, starting with the basics.

Read guides, keep up to date with the latest news and follow market analysts on social media. Due to the availability of leverage, forex traders can make a return on a single trade that is multiples of the margin they used to open the trade.

Trading forex - what I learned

However, leverage is a double edged sword in that big gains can also mean big losses. Therefore, reliance on excessive leverage as a strategy typically leads to destruction of your account capital over the long run. This is because it only takes one adverse market move to drive the market far enough and trigger substantial losses.

Your expectations on a return on investment is a critical element. When traders expect too much from their account, they rely on excessive leverage and that typically triggers a losing account over time. View forex like you would any other market and expect normal returns by using conservative amounts of no leverage. Since forex is a 24 hour market, the convenience of trading based on your availability makes it popular among day traders, swing traders, and part time traders.

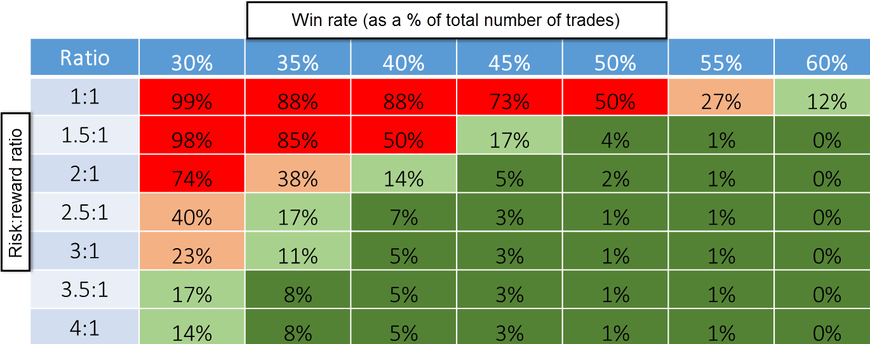

Regardless of your style, use small if any amounts of leverage. If you were to expand the list to a fourth thing learned when starting to trade FX, what would it be? I touched on leverage above. We researched millions of live trades and compiled our results in a Traits of Successful Traders guide. In the guide we touch on risk to reward ratios and how it is important.

With humans being human, we also touch on the psychological element that goes along with trading and why we may still make poor choices even if we know what is right. Sometimes our biggest obstacle is between our ears. We have compiled a comprehensive guide for traders new to FX trading. This guide includes topics like why traders like FX, how do you decide what to buy and sell, reading a quote, pip values, lot sizing and many more.

From my experience, learning how to decide what market to trade in FX is important. We also recommend the resource building confidence in trading which is found in the beginners tab of our trading guide resource section. Forex brokers often don't charge a commission, but rather increase the spread between the bid and ask , thus making it more difficult to day trade profitably.

This estimate can show how much a forex day trader could make in a month by executing trades:. This may seem very high, and it is a very good return.

10 Ways to Avoid Losing Money in Forex

See Refinements below to see how this return may be affected. It won't always be possible to find five good day trades each day, especially when the market is moving very slowly for extended periods. Slippage is an inevitable part of trading. It results in a larger loss than expected, even when using a stop-loss order. It's common in very fast-moving markets. You can adjust the scenario above based on your typical stop loss and target, capital, slippage, win rate, position size, and commission parameters.

Most traders shouldn't expect to make this much; while it sounds simple, in reality, it's more difficult. The Balance does not provide tax, investment, or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk including the possible loss of principal. Admiral Markets. Actively scan device characteristics for identification. Use precise geolocation data.

Select personalised content. Create a personalised content profile. Measure ad performance.

Select basic ads. Create a personalised ads profile. Select personalised ads. Apply market research to generate audience insights. Measure content performance. Develop and improve products. List of Partners vendors. Trading Forex Trading.

How do Forex Traders make money?

Table of Contents Expand. Table of Contents. Day Trading Risk Management.