Trade your way to the top. Open Your Free Account!

Table of contents

- 3 of the best forex charting tools for traders

- Euro - Dollar Chart

- Table of Contents

- Most Commonly Used Forex Chart Patterns

Live Webinar Live Webinar Events 0. Economic Calendar Economic Calendar Events 0. Duration: min. P: R:. Search Clear Search results. No entries matching your query were found. Free Trading Guides. Please try again. Subscribe to Our Newsletter. Rates Live Chart Asset classes. Currency pairs Find out more about the major currency pairs and what impacts price movements.

3 of the best forex charting tools for traders

Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Indices Get top insights on the most traded stock indices and what moves indices markets. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Fed Bostic Speech.

P: R: Consumer Confidence MAR. Company Authors Contact. Long Short. When you choose a currency pair, the chart generated will show how many US dollars you can buy for one Euro. Determine the time period you want to be displayed. The chart shows how the exchange rate between the two currencies changed over time. In a candlestick chart, each candlestick accounts for a specific time period set. Traders will also set the overall time period, which determines how many candlesticks they have.

Distinguish bullish candles from bearish candles. The coloration of bullish candles and bearish candles depends on the service generating the chart and some use different colours. Check the key of the chart to understand what the colours mean.

Identify the parts of the candlestick. The top and bottom lines of the candle itself display the opening and closing exchange rate for the pairing chosen, by the coloration of the candle body traders will know which one is the opening and which is the closing. Traders will then see lines extending from the top and bottom of the candle, giving rise to the name of the chart. Learn the names of candlestick patterns with predictive value.

Place the patterns in context on the chart. Once traders know how to identify types of candlesticks, look at their relative position on the chart. A filled candle, means that the opening price is higher than the closing price. So in other words, the price has come down in that specific time period. This is also known as a bearish candle. A downward movement in the Forex is also known as a bearish move. A hollow, unfilled candle means that the closing price is higher than the opening price in other words, the price has gone up in that specific period — also known as the bullish candle.

An upward movement in the Forex is known as a bullish move. Together, the body with the shadows of a candlestick are critical elements in defining relevant patterns. Here are some of the most famous candlestick chart patterns:. For traders who want to go the extra mile, expert trading charts exist — Heiken-Ashi, Renko and point and figure charts. These kinds of charts are used to spot false market moves, or to better ride the main trends. Two of the Forex chart types in this category come from Japan.

Point and figure charts resemble Renko charts, their purpose — to filter the time when the market consolidates and only to display relevant candles when the market is on the move. Trading with chart patterns in Forex is familiar to every retail trader and technical analysis has existed for centuries. Market efficiency has been subject to strong discussions for years, with technical analysts arguing that a profit can be made as markets are irrational.

Euro - Dollar Chart

This irrationality comes from the erratic behaviour of the masses. This is the main substance of technical analysis. Trading with chart patterns is an essential component of every technical analyst, because a chart records every price level through time. This helps traders interpret the data through reading chart patterns. When trading with chart patterns, it is said that the trader has a pattern recognition approach, which means that the trader focuses more on price action and what the pattern shows, rather than particularities of a specific market.

Therefore, one of the most common chart patterns in Forex, are triangles. Triangular patterns come in many types and shapes. The catch? Popular chart patterns in Forex, wedges appear everywhere.

Table of Contents

Two types of wedges exist:. Some particularities of rising and falling wedges exist, known as reversal patterns. The chart patterns in Forex evolved in time and they will continue to do so as markets evolve. As shown, reversal patterns might act as continuation ones, too. In most of the chart patterns in Forex, using proper risk-reward ratios is mandatory.

Therefore, the chances that new types of charts will appear are high. Traders use forex charts as a tool because it present them with useful information for the technical analysis of a specific forex pair. The difference is found in the individual price and quotes therefore a broker will have charts that differ slightly for respective users. What are the best charts to trade forex? The theoretical side of forex takes about months depending on how fast you learn. The practical side can take about one year.

According to research in South Africa, RoboForex Group has been operating since through two worlds presented entities namely RoboForex, with […]. View Share. All data is delayed by at least 15 minutes. Read Review. Download our free e-book.

Most Commonly Used Forex Chart Patterns

Download Free ebook PDF. Skip to content Search. Forex an abbreviation of foreign exchange relates to the process of purchasing and selling different currencies within the foreign exchange market. In the international forex market, investors, shareholders and retailers influence the relative value for converting one currency into another by acquiring and trading currency pairs. Successful forex traders benefit from the changes in value between different international currencies by choosing two currencies and predicting which will go up in value compared with the other.

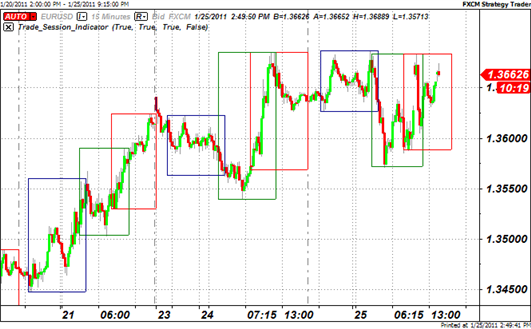

Traders often use forex charts to help them to gain a better understanding of past performance; this information is then used to help them make informed trading decisions in the future. Since forex charts can signal uptrends and downtrends in currency performance, they can be a helpful resource when it comes to planning your next trading move. If you want to get started with forex trading, you will soon come to realise the importance of tracking currency movements.

One of the most effective ways to achieve this is by using forex charting software. There are many different options available, so it's important to look for one that will suit your skill level and trading style. One of the most popular forex trading software solutions is TradingView. This software offers a free basic solution which can be used to trade any market. It is cloud-based, so you can access it from any device.

TradingView is designed to meet the needs of new and experienced traders alike. There are plenty of customisation options to ensure it meets your needs and you can set up alerts to prompt you when your favourite currency pairs begin to move. If you would prefer to use an ad-free service, there are three different paid-for options which offer a range of additional benefits. Forex charts can help traders to recognise patterns, gain an understanding of how many traders are trading in a market and identify areas of support and resistance.