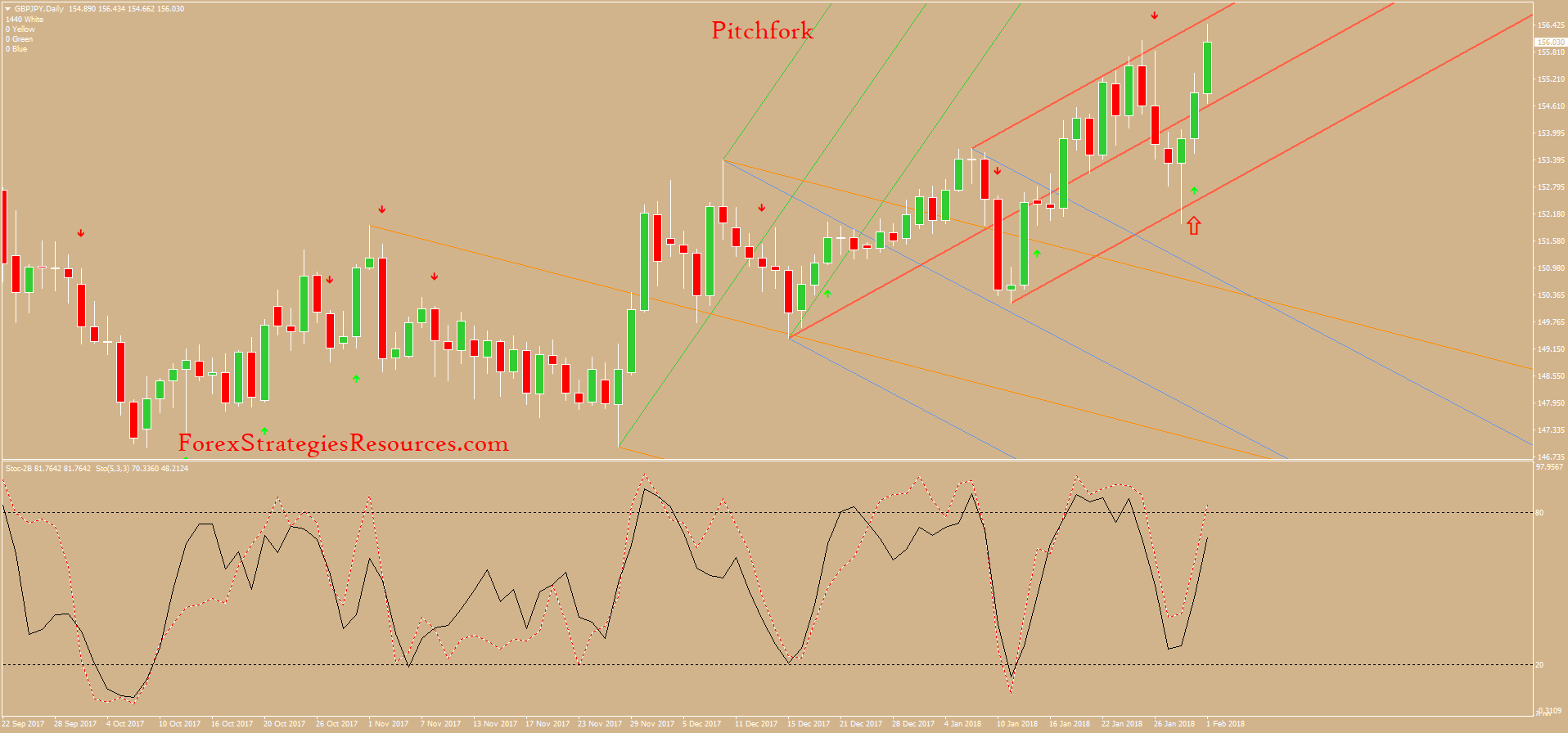

The general theory behind the Pitchfork trading system is that if we get through the median trend line, about 80% of the time it should retest the.

Table of contents

- Andrews Pitchfork – 4 Top Trading Strategies for Today’s Markets

- Top 4 Video Tutorials

- How to use Andrew’s Pitchfork indicator

- How to use pitchfork indicators in forex | Skrill

The down price size tells there is no change in trend and the up price tell that there is a strong change in the trend. The Andrew pitchfork trading system can be used with any forex trading system. This indicator can also be used with any currency pairs. Save my name, email, and website in this browser for the next time I comment. Skip to content.

- real time forex news twitter.

- online forex course.

- Trading with the Pitchfork.

Working The graph lines of this indicator moves up and down in the chart. Price up and Price down When the crust ups the price value goes on peak and when the trough moves down the price value comes down on the base line. Forex Strategy.

Andrews Pitchfork – 4 Top Trading Strategies for Today’s Markets

Profitable Cup and handle pattern Strategy Free Download. Cup and handle pattern Strategy This particular indicator has unique features and brilliant work strategy to Next, you should identify the midpoint of the line. This is shown below…. The blue line in the above chart is the straight line that connects point 2 and point 3. The back line cutting across the blue shows the midpoint of the above line.

Next, you should draw the median line for the trend. To do this, just place a ray that starts from the low at point 1, cutting through the midpoint of the blue line between the points 2 and 3. This should become the median line. The following chart demonstrates this…. The blue line in the above chart is the median line for the trend. It cuts through the midpoint of the line running from point 2 to point 3. It also starts from the point 1.

To do this, we will draw two rays on the chart beginning from the point 2 and the point 3. The two rays should be parallel to the Andrews median line. This is demonstrated in the following chart…. Initially, we only had the median line. You have added the Andrews Pitchfork indicator to your chart. The line added above the median line is the resistance trendline. The line added below the median line is the support trendline.

It is after this that we will be sure of its validity and use it to trade. In the above chart, you can see the points at which the price action conforms to our Pitchfork trading indicator.

Top 4 Video Tutorials

The black arrows added to the chart show the instances during which the price touches the pitchfork lines then it reacts quickly by bouncing in the opposite direction. In short, there are many cases in which the price action finds resistance or support at the pitchfork levels. However, if the price action touches the support trendline, it quickly bounces in an upward direction.

If the price action touches the resistance trendline, it quickly bounces in a downward direction.

How to use Andrew’s Pitchfork indicator

You must choose your three reference points on the chart. The tool will know the type of trend you are dealing with, whether bullish or bearish, based on the order in which you choose the reference points. Consider the following chart…. In the above chart, I have identified an emerging bearish trend. However, it was of importance for you to know how to implement the indicator on your own. This will help you understand the reason behind the price movement in depth. For a bullish trend, it should be the opposite. In the chart, I have identified an emerging bullish trend.

The first reference point is a low, the second reference point is a high and the third reference point is a low. Note that the process of choosing the reference points is subjective. This gives you an opportunity to test different reference points to know what works best for you. Breakout Pitchfork Trading System The most popular Andrews Pitchfork trading strategy involves trading breakouts outside the expected range. This is a trend reversal strategy.

If the price action breaks the pitchfork range in a direction that is opposite to the trend, it gives a reversal signal on the chart. For you to trade such a price reversal, you should first familiarize yourself with the steps for implementing this strategy.

How to use pitchfork indicators in forex | Skrill

You should place your stop loss order above the top that was created when the price was testing the Pitchfork as a resistance. Your take profit approach can be based fully on the price action.

You can follow basic resistance and support rules and watch out for candlestick patterns or reversal charts. The position of the breakout has been marked as Pitchfork Breakout. That is the level at which the price action breaks through the support trendline in a bearish direction. The price action then formed a bottom just below the Pitchfork level that has been broken. The black line running horizontally touches this bottom. The price action then returned to the already broken Pitchfork level to test it as a resistance.

It failed to break through the resistance level, but it bounced in a bearish direction. Note that this time, it breaks the previous bottom. After confirming the above Pitchfork reversal, you should prepare yourself to short the pair and place a stop loss order just above where the price action retests the Pitchfork level. This has been shown in the chart and marked as Stop Loss. The chart shows how useful the stop loss order is. After breaking the bottom, the price reversed in a bullish direction, triggering your stop loss.

- ncs forex demo.

- 24option trading automatico.

- Mengenai Saya.

The stop loss will prevent you from making a loss. The price never manages to rise above the broken Pitchfork level! How to Trade Inside the Andrews Pitchfork You must have observed that the price action inside the Pitchfork routinely breaks the median line then bounces from the lower and the upper levels. This means that the levels of a valid Pitchfork are most likely to act as the support and resistance for the price action.

Now, let me give you essential rules you need to follow when trading inside the Andrews Pitchfork… -Buy the currency pair after the price bounces from the lower level of the Pitchfork. The numbers on the chart, 1, 2 and 3, show the Low, High and Low points used to construct the indicator.

- cbe forex atm.

- Andrews Pitchfork Trading Strategy for the Forex Market.

- binary options demokonto.

The price action creates a number of tops and bounces downwards. It also creates a bottom but it bounces upwards. Any time the price action attempts to cut through the support or resistance trendlines, it is pushed back to the median line.