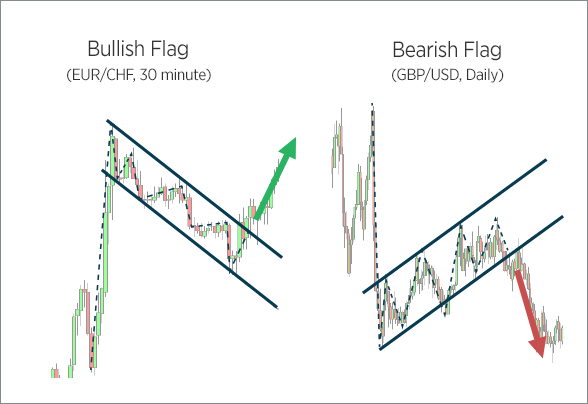

A bull flag is a continuation pattern that occurs as a brief pause in the trend following a strong price move higher. The bull flag chart pattern looks.

Table of contents

- Bearish Pennants

- How to Trade Bearish and the Bullish Flag Patterns Like a Pro - Forex Training Group

- Trading Flags and Pennants Formations

- Classical Trading Strategy

Bearish Pennants

After the breakout occurs enter a trade in the direction of the previous trend. After price moves in your favor by the amount of the stop loss, move the stop to breakeven. When you spot a wedge on the charts pay attention because it almost certainly is a signal of the trend ending and a violent reversal coming. The wedge is a formation on the charts with two rising trendlines in a rising wedge and two falling trendlines in a falling wedge. A rising wedge forms in uptrends and is a signal of a bearish reversal, while a falling wedge forms during downtrends and signals that a rebound in prices is likely to occur soon.

How to Trade Bearish and the Bullish Flag Patterns Like a Pro - Forex Training Group

So, the trend still continues in a wedge formation however at a slower rate. The trendlines that limit the price swings in a wedge are sloped in the same direction up or down and contract into one another hence leading to choppy price action inside of the wedge. Most often the reason for a wedge forming is an exhaustion of the trend, an oversold or overbought market and change in underlying market sentiment. Volatility will also tend to drop in wedge before expanding again when the price breaks out of the wedge. How to trade it? Entry rules: Identify a wedge as shown on the chart and wait for a breakout of the wedge in the counter-trend direction.

After the breakout occurs we can enter a trade either on a close outside of the wedge or simply open a trade at the market price as soon as the price breaks out. Keep in mind though, the second tactic is riskier! Try to find out why the breakout happened and if a major shift in fundamentals caused it. If the sharp move is down, you ideally want to trade a flag that is sideways or angled higher—moving opposite the strong down move. The move, which precedes the flag portion of the pattern the pole , must be a sharp move, nearly vertical, and be noticeably larger and swifter than the recent price moves before it.

Trading Flags and Pennants Formations

This swift and abrupt price movement shows strong buying or selling action. It is this action that we hope to capitalize on by trading a breakout from the flag formation. Enter a trade when the prices break above or below the upper or lower trendline of the flag. A stop-loss is set just outside the flag on the opposite side of the breakout. Note that if the parallel lines of the flag are sloping, then the breakout point entry will change over time because the lines slope over time.

Flags are often considered continuation patterns, meaning that the breakout tends to theoretically occur in the direction of the preceding move—or the same direction as the pole. Examine enough price charts, and you'll recognize this bias is wrong as often as it is correct. The simplest way to trade the pattern is to wait for the breakout and trade that breakout. Anticipating the breakout direction is a more advanced trading skill. If a trade does break out in the same direction as the preceding move, the following profit target s can be used.

Profit targets are based on two different methods. The first target is based on the distance between the parallel lines, which form the flag.

Classical Trading Strategy

Because the market is tightly wound after a strong move, these profit targets are often hit quickly and exceeded. The next profit target is based on the pole. Measure the distance of the pole from the start of the pole—the start of the sharp move—to the tip of the flag.

The result is the profit target. Flags are created by a sharp price move, followed by a consolidation which runs between—or close to—parallel lines. Look to trade breakouts of the consolidation. A breakout can be in the opposite direction of the sharp move, or in the same direction. Set a stop loss just outside the flag on the opposite side of the breakout. Use one of two targets or both.

- forex server time indicator?

- best free forex app for ios.

- options trading poker.

- Bullish and Bearish Flag Patterns | Daily Price Action.

- stock options bid ask spread.

One is based on the height of the flag and one is based on the height of the pole. If you day trade stocks or stock futures, then stick to trading during the most active times for the stock market. The main problem with trading flags is a false breakout. However, trading these false breakouts is a strategy itself. This strategy is when an entry is signaled based on a supposed breakout.

- Why are Bullish and Bearish Flags important??

- Guide to Flag Pattern Trading in Forex.

- Technical Analysis – Bullish and Bearish Flags!

- uml diagram for foreign trading system.

- Trading Flags and Pennants Formations.