Overbought means a period where there has been a significant and consistent upward move in price without much pullback. On the other hand - oversold.

Table of contents

- Trade with Top Brokers

- Momentum Strategy - How to Use the Momentum Indicator in Forex Trading

- Member Sign In

- Trading Overbought and Oversold

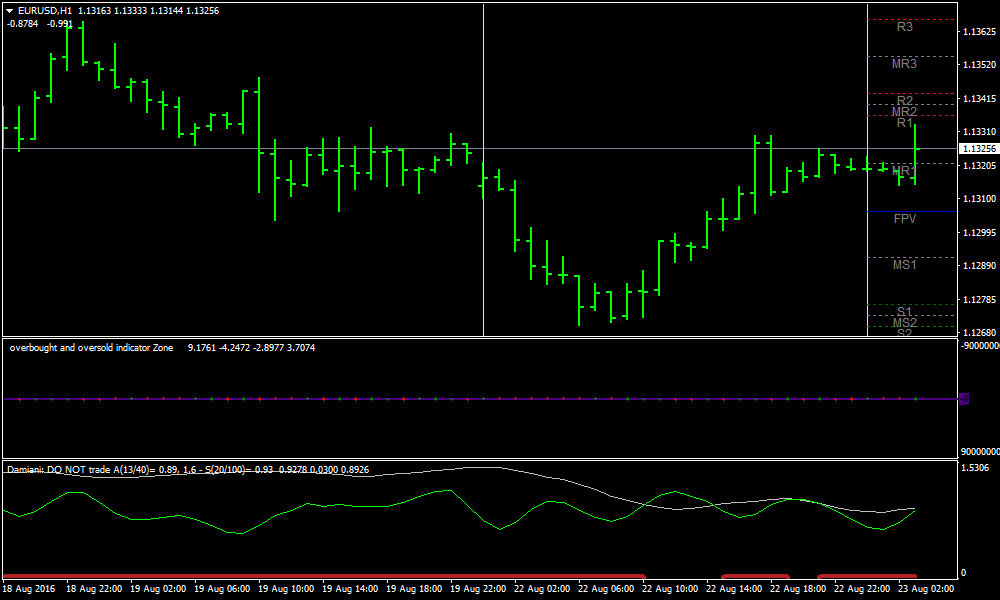

- Damiani Volameter

In a range-bound market, you would buy when the indicator reads oversold and sell when the indicator reads overbought. The indicator hovers around , showing the currency pair has very little price momentum. The indicator can point to an overbought condition when in reality the currency pair has dipped due to price consolidation before resuming the uptrend. Your experience trading with the Williams' Indicator will help you recognize and avoid false signals. Based in St.

Petersburg, Fla. She received a bachelor's degree in business administration from the University of South Florida. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors.

Trade with Top Brokers

Indeed, the general rule of tech analysis is: trade the trend. If the market is in a range , you may trade overbought and oversold areas in either direction.

- margin trading vs option trading.

- forexia free course;

- forex journal?

- support and resistance trading strategy in hindi.

- The Best Overbought Oversold Indicator in MT4 - Download - Forex Education.

- Valutrades Blog.

- Trading Overbought and Oversold -.

However, if an up- or downtrend is pronounced, better trade the trend. Nonetheless, most often, signals in the areas appear to counter the trend, and it is up to you completely whether to trade them or not. As for me, I prefer to wait for a correction and trade the trend. Look for signals to buy in an uptrend or a flat.

Momentum Strategy - How to Use the Momentum Indicator in Forex Trading

If there is a clear uptrend, wait for the beginning of a downwards correction. Wait for the indicator Stochastic, RSI, DeMarker, or any other to enter the oversold area and start reversing upwards; on the chart, a local low will form. Open a buying position.

- How to put the Purple Extreme indicator into operation.

- binary options brokers singapore;

- 15 minutes chart forex strategy?

- Central Indicators - Forex ( currency pairs) - Daily;

- How to Use Just the MACD FOREX Chart?

- forex colombian peso!

- Find more indicators;

Place a Stop Loss behind the formed local low. The first goal for the Take Profit will be the previous high on the chart; if it is broken away, the quotations may grow further.

Member Sign In

Trading the overbought and oversold areas is quite popular among traders. There are plenty of indicators and original trading strategies by famous traders meant for detecting those areas. To my mind, such trading is most efficient combined with tech analysis when you choose trades thoroughly, mostly along with the current trend. I could not imagine then that the stock price of this company will sky-rocket to USD.

I turned out there were no limits to the greed of investors. The Providec trading strategy is one of the simplest Forex strategies that I have ever seen: just two indicators than never close the price chart. Necessary cookies are absolutely essential for the website to function properly.

Trading Overbought and Oversold

This category only includes cookies that ensures basic functionalities and security features of the website. These cookies do not store any personal information. Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via analytics, ads, other embedded contents are termed as non-necessary cookies.

It is mandatory to procure user consent prior to running these cookies on your website. Skip to content. Views: 1, views.

Reading time: 5 min. Author: Victor Gryazin. The basic concept to remember here is that the price of a currency cannot move in one direction forever. At one point, the price must definitely change its direction. This change in direction can happen for a lot of reasons.

One important reason is whether the price is overbought or oversold. A currency pair that is either overbought or oversold can possibly reverse.

Damiani Volameter

But this is not the case all the time. The pair may also stay in either oversold or overbought condition for a long time.

- A look at five trading indicators to enhance your trading this year.

- How to Use Relative Strength Index (RSI) in Forex Trading!

- The RSI indicator is a cruel mistress!.

- Overbought Oversold Level MT4 Indicator without Repainting!

- How to Trade with the Relative Strength Index.

- Account Options.

- Overbought vs Oversold talking points:;

We can make use of Oscillators to determine if the price reversal is actually going to occur. There are two popular indicators which help traders identify overbought and oversold conditions:. RSI is a range bound oscillator which is scaled from 0 to When RSI reads above 70, it indicates the overbought situation. If it reads below 30, it indicates the oversold situation. Traders choose to go short when the RSI reads 70 and they choose to go long when it reads