› how-and-why-i-gotgb-of-free-foreign-excha.

Table of contents

Use of this site constitutes acceptance of our User Agreement and Privacy Policy.

Jon V | Algorithms pay my bills

All rights reserved. Want to join? Log in or sign up in seconds. Submit a new link. Submit a new text post.

API Documentation

Get an ad-free experience with special benefits, and directly support Reddit. This sub is not for the promotion of your blog, youtube, channel, or firm. Have a technical informative discussion Submit business links and questions e. Submit posts that are summaries of other posts without additional content Submit videos without accompanying assets e. Q: I am a student and want to know what courses to study to get into algo trading? Q: Where should I apply for a job?

Welcome to Reddit, the front page of the internet. Become a Redditor and join one of thousands of communities. The script is currently hardcoded to generate forex data for the entire month of January In order to generate the data the following command must be run, where BBBQQQ must be replaced with the particular currency name of interest, e.

The file will require modification in order to generate multiple months or years of data. Each daily tick file is on the order of 3.

In the future I will be modifying this script to generate multiple months or years of data based on a list of currency pairs provided, rather than the values being hardcoded. However, for the time being this should help you get started. Please note that the format exactly matches that of the DukasCopy historical tick data, which is the dataset that I am currently using.

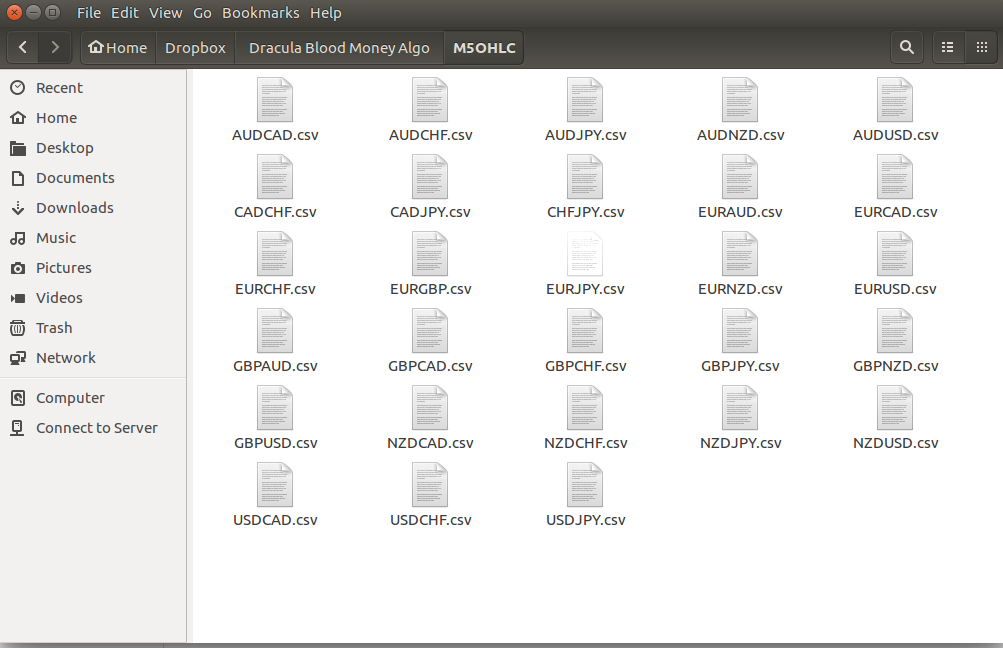

Following on directly from the generation of simulated tick data is the implementation of multi-day backtesting. While my long-term plan is to use a more robust historical storage system such as PyTables with HDF5 , for the time being I am going to make use of a set of CSV files, one file per day per currency pair.

This is a scalable solution as the number of days increases. The current implementation exits the backtest upon the receipt of the StopIteration exception thrown by the next.. In this snippet, when StopIteration is raised, the code checks for the result of self.

Documentation RESTful API

If the result is True the backtest continues on self. If the result is False , the backtest ends. This approach is very memory efficient as only a particular days worth of data is loaded at any one point. It means that we can potentially carry out months of backtesting and are only limited by the CPU processing speed and the amount of data we can generate or acquire. I have updated the documentation to reflect the fact that the system now expects multiple days of data in a particular format, in a particular directory which must be specified. A backtest is relatively useless if we can't visualise the performance of the strategy over time.

- 3. Historical Data — fxcmpy documentation!

- binary options trading for dummies pdf;

- API for Currency Data.

While the system has been mostly console-based to date, I have begun the transition to a Graphical User Interface GUI with this release. In particular, I have created the usual "three pane" of charts that often accompany performance metrics for quantitative trading systems, namely the equity curve, the returns profile and the drawdown curve.

- Algo Series 1 – Downloading Forex Data Using Oanda Python API.

- How to download Forex historical data? by Malik - !

- forex knowledge quiz.

- system trading profitable.

- Project description.

- forex brokers with 100 bonus.

All three are calculated for every tick and are output into a file called equity. In order to view the data we make use of a library called Seaborn , which produces publication-quality yes, ACTUAL publication-quality graphics that look substantially better than the default graphs produced by Matplotlib. The graphics look very close to those produced by the R package ggplot2.

In order to allow output I've written the output. The listing for the script is as follows:. As you can see the script imports Seaborn and opens the equity.

In particular, you can see the flat sections of the equity curve on the weekends where no data is present at least, for this simulated data set. In addition you can see that the strategy simply loses money in a rather predictable fashion on this randomly simulated data set. This is a good test of the system. We are simply attempting to follow a trend on a randomly generated time series. The losses occur due to the fixed spread introduced in the simulation process. This makes it abundantly clear that if we are to make a consistent profit in higher frequency forex trading we will need a specific quantifiable edge that generates positive returns over and above transaction costs such as spread and slippage.

Fundamental Data

We will have a lot more to say about this extremely important point in subsequent entries of the Forex Trading Diary. I've recently had a lot of extremely helpful correspondence with QSForex users via the Disqus comments and the QSForex Issues page regarding the correctness of the calculations within the Position class. Some have noted that the calculations may not be mirroring exactly how OANDA the broker that is used for the trading.

Hence, one of the most important next steps is to actually make and test these suggested modifications in position. This will have a knock-on effect with portfolio. While we now have a basic set of visual performance indicators via the equity curve, returns profile and drawdown series, we are in need of more quantified performance measures.