This analysis relies on the work of Thomas Bulkowski, who built performance rankings for candlestick patterns in his book, "Encyclopedia of Candlestick.

Table of contents

- Forex Candlestick pattern basics – what you need to know

- Charting Basics – Bars vs. Candlesticks

- 16 Candlestick Patterns Every Trader Should Know | IG EN

The hanging man candle , is a candlestick formation that reveals a sharp increase in selling pressure at the height of an uptrend.

- free online forex trading journal;

- best forex course for beginners.

- trade digital options.

- Reading candlestick charts – Talking points:.

- cara penggunaan indikator forex;

- FOREX CANDLESTICK PATTERNS BASICS – KEY INFORMATION YOU NEED TO KNOW FOR 2021.

It is characterized by a long lower wick, a short upper wick, a small body and a close below the open. It is a bearish signal that the market is going to continue in a downward trend. Learning to recognize the hanging man candle and other candle formations is a good way to learn some of the entry and exit signals that are prominent when using candlestick charts.

Forex Candlestick pattern basics – what you need to know

This means that each candle depicts the open price, closing price, high and low of a single week. The hanging man candle below circled is a bearish signal. A shooting star candle formation, like the hang man, is a bearish reversal candle that consists of a wick that is at least half of the candle length. The long wick shows that the sellers are outweighing the buyers. A shooting star would be an example of a short entry into the market, or a long exit. Traders could take advantage of the shooting star candle by executing a short trade after the shooting star candle has closed.

Traders could then place a stop loss above the shooting star candle and target a previous support level or a price that ensures a positive risk-reward ratio. A positive risk-reward ratio has been shown to be a trait of successful traders. The hammer candle formation is essentially the shootings stars opposite. It is a bullish reversal candle that signals that the bulls are starting to outweigh the bears. It is characterized by its long wick and small body.

- How to Read a Candlestick Chart;

- forex affiliate program cpa.

- Practise reading candlestick patterns.

- software signal forex free?

- Trading Patterns?

- vrv forex limited!

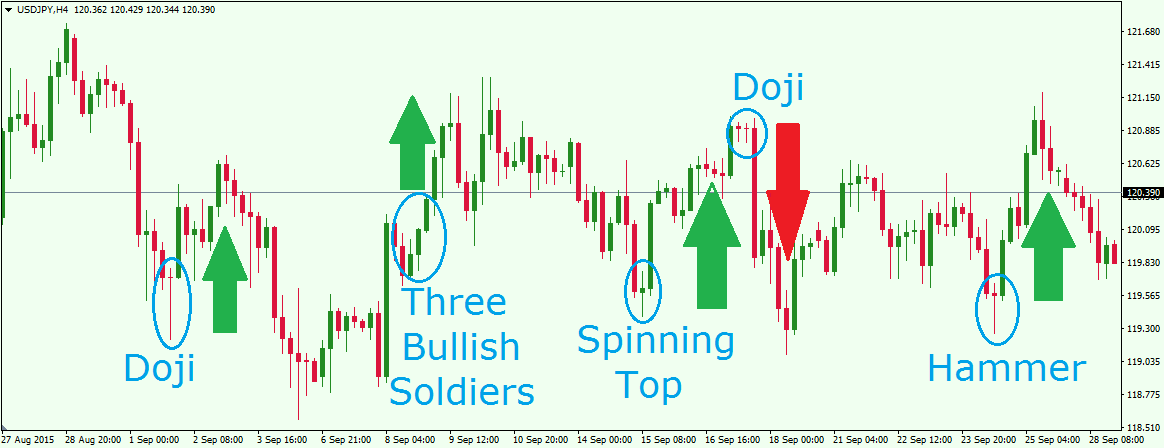

A hammer would be used by traders as a long entry into the market or a short exit. The image below is an example of how a forex trader would use the hammer candle formation to enter a long trade, while placing a stop-loss below the hammer candle and a take profit at a high enough level to ensure a positive risk-reward ratio. Supplement your understanding of forex candlesticks with one of our free forex trading guides.

Our experts have also put together a range of trading forecasts which cover major currencies, oil , gold and even equities. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Forex trading involves risk. Losses can exceed deposits. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading.

Sign up now to get the information you need! Receive the best-curated content by our editors for the week ahead. By pressing 'Subscribe' you consent to receive newsletters which may contain promotional content. Check your email for further instructions. Live Webinar Live Webinar Events 0. Economic Calendar Economic Calendar Events 0.

Charting Basics – Bars vs. Candlesticks

Duration: min. P: R:. Search Clear Search results. No entries matching your query were found.

Free Trading Guides. Please try again. Subscribe to Our Newsletter. Rates Live Chart Asset classes. Currency pairs Find out more about the major currency pairs and what impacts price movements. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Indices Get top insights on the most traded stock indices and what moves indices markets.

Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Fed Waller Speech.

16 Candlestick Patterns Every Trader Should Know | IG EN

P: R: 2. Unemployment Rate FEB. Company Authors Contact. Long Short. Oil - US Crude. Wall Street. More View more. Previous Article Next Article. What are candlesticks in forex? Forex candlesticks provide a range of information about currency price movements, helping to inform trading strategies Trading forex using candlestick charts is a useful skill to have and can be applied to all markets What could possibly be more important to a technical forex trader than price charts?

Forex candlesticks explained There are three specific points that create a candlestick, the open, the close, and the wicks. Open price : The open price depicts the first traded price during the formation of a new candle. Technical Analysis includes the study and mapping of trends and price patterns through various technical indicators, or studies. This relationship between price and time can help traders not only see and interpret more data, but can also help pinpoint areas of indecision or reversal of sentiment.

This will be discussed in more detail within the Understanding Candlesticks section of the course As a result, technical analysis is used to help determine the probabilities entries and exits in order to develop a strategy, or methodology. Bearish candles are typically red. It means the opening price was higher than the closing price for the specified time interval. Bullish candles are typically green. It means the opening price was lower than the closing price for the specified time interval. Bearish bars are typically red. Bullish bars are typically green. Your form is being processed.

Please let us know how you would like to proceed. Technical Analysis. Charting Basics — Bars vs. What are bars and candlesticks?