Forex Brokers with Micro Accounts · Platforms. MetaTrader 4; MetaTrader 5; Mobile Trading Platform; Web Trading · Countries. CY GB SC · Regulation. CySEC, /.

Table of contents

- Forex Brokers with Micro Accounts — Micro-Lot Forex Trading

- What is Forex Trading?

- Forex Forecasts

- Forex Brokers with Micro Accounts

Trading forex with a micro account makes it possible for traders to start trading with a smaller amount of capital. Traders also sometimes use micro accounts to try out new brokers with a live account whilst reducing the risks. With micro accounts, traders can open trades with contract sizes starting from 1, lots rather than the larger , standard lot.

This allows traders to refine their trading strategy with smaller deposits before moving to larger account sizes. It used to be the case that with smaller micro accounts the leverage offered by brokers is often larger, but this has since been changed with ESMA limiting the amount of leverage offered to traders to a maximum of on major forex pairs for less experienced traders. Below, we have compiled a top five list of top regulated brokers that offer accounts to make micro trades 1, lot contract size. Avatrade gets credit as the broker that brought digital currency trading into the market.

It is also among the first brokers to introduce CFD trading. Traders can make deposits through wire transfer, Neteller , Paypal , or credit cards. The broker facilitates trading on the AvaTrade platform, which offers various features and customisation options.

When trading forex, a trader does not have to pay for the advanced trading tools, just the spreads. There is also the availability of the platform on mobile devices. The Ireland-based broker operates under EU regulations. There is a demo account as well that traders can use before opening a live account.

Forex Brokers with Micro Accounts — Micro-Lot Forex Trading

The broker offers competitive spreads and lot of 0. More than 5, markets are available for traders, which include currency pairs, shares, and indices. One of the reasons traders prefer it is because its holding company is traded publicly on the London Stock Exchange. Trading is on the MT4 platform with 39 currency pairs, indices, and commodities.

Payment methods supported by the broker include Skrill, Paypal, and major credit cards.

It offers one account type and demo. Micro accounts are one of three types of forex trading accounts, the other two being the mini account and standard account. With a micro account, a trader can trade with a contract size of units of currency. This type of trading account is mostly utilised by beginner traders as it lets them trade the forex market without having to risk a substantial amount of trading capital.

What is Forex Trading?

The difference between a micro account and a mini account is the contract size. While the contract size for a micro account is units of currency, the contract size of a mini account is 10, units of currency. Furthermore, with each account comes different benefits and trading conditions. So, for instance, you may get offered lower spreads and a higher leverage with a larger account type.

The difference between a micro account and a standard account is the contract size traded.

Forex Forecasts

With a micro account, the contract size is units of currency whereas, with a standard, the contract size is , units of currency. In addition, most micro accounts do not have a minimum deposit whereas standard accounts generally require a minimum deposit of a few thousand dollars.

Micro accounts are good for beginner traders as it lets them trade with a smaller investment capital and hence enabling them to manage their trading risks better. At the same time, micro accounts also help traders to limit their trading losses. The key advantage of a micro account is the fact that it enables a beginner trader to limit his trading losses while having exposure to real life market experiences. It is, therefore, an ideal way for a new trader to practice trading in the markets, without risking large amounts of capital.

The main disadvantage of a micro account is the fact it limits your profit potential, as you will be trading with just a small investment capital. In addition, the spreads on a micro account are normally higher than a standard account. In forex trading, demo accounts allow traders to trade the market with virtual money. Demo accounts give traders experience without them having to risk any money.

However, because demo account users are trading with virtual money, they will not be able to actually experience how it feels to actually lose or profit a trade with real money. In effect, it negates the psychological aspect of trading. With a micro account, a beginner trader can feel how it is to trade in real life with real money, with real risks, while still only risking only a small portion of their capital.

- false breakout forex.

- Best Forex Brokers - Top 10 Brokers - .

- kritika trade system.

- options trading youtube!

- Get More than a Forex and CFD Trading Account at XM.

The suitability of a micro account will depend on your trading objectives. If you are aiming to gain more trading experience while risking minimal investment capital, then the micro account will be a good fit for your trading objectives.

However, if your trading objectives are lower trading costs and higher profit potential, then the micro account might not be a suitable trading account for you. Here are some areas where AvaTrade scored highly in:. AvaTrade have a AAA trust score. XTB vs. Enjoy lower spreads and powerful platforms. Fine-tune your trading strategies with the latest technical and fundamental analysis. Nothing should get in the way of making your best trade. We offer three free online trading platforms. MetaTrader 4 , our most popular; MetaTrader 5 , our most powerful; and cTrader , our most user-friendly.

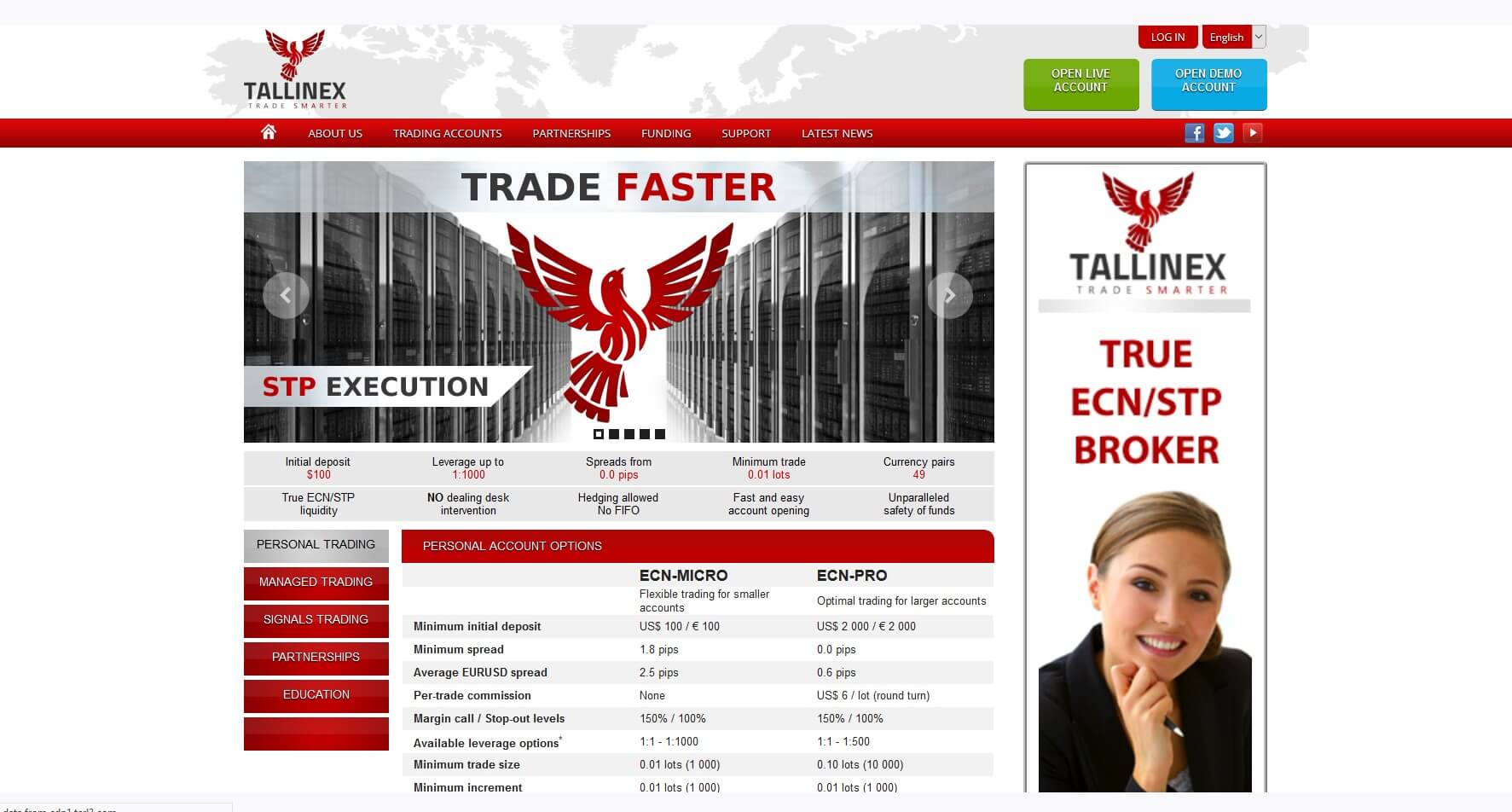

Forex Brokers with Micro Accounts

All of our platforms are available to run via WebTrader and mobile apps for seamless syncing across all of your devices. It's quick and easy to get started — even with a small deposit. Apply in minutes with our simple application process. Start trading now Try demo. View all spreads. Why Pepperstone? Trade with confidence.

Protect your money with a regulated broker. Choose from a wide range of funding methods with local bank options. Unlock more opportunities. Enjoy seamless trading with fast execution speeds.