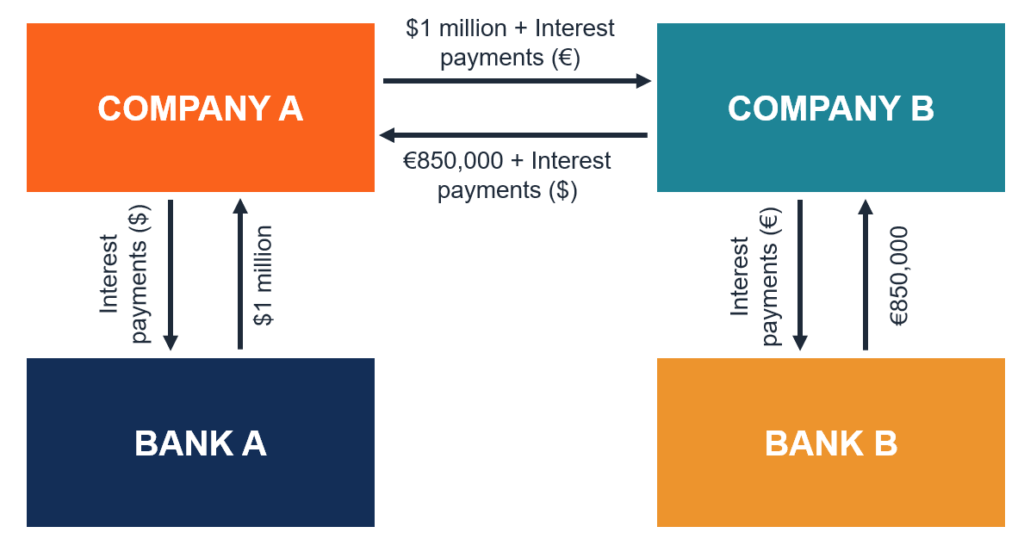

A foreign currency swap, also known as an FX swap, is an agreement to exchange currency between two foreign parties. The agreement consists of swapping principal and interest payments on a loan made in one currency for principal and interest payments of a loan of equal value in another currency.

Table of contents

- Exchange for Swap (EFS) Definition

- What is Swap in Forex? | FX Swap Definition & Strategy

- Navigation menu

- Factbox: FX swaps step from market obscurity to global stage

So, for example, if the bid price was 1. For traders, the best spreads are simply those which are the lowest. However, traders also need to decide whether fixed or variable spreads are more suited to their trading style. You may also consider a zero-spread account but do note that although the spreads on these accounts are exceptionally low, the broker is likely to charge commission. To avoid swap fees when trading forex, you need to close your positions at the end of the day.

Exchange for Swap (EFS) Definition

This translates to EST. You can hold a position for as long as you want, from minutes to days or even months. However, for each day you hold your position, you will be charged a swap fee. It is, therefore, wise to calculate how much you will be charged for holding your position for a longer period, before doing so. We at Topratedforexbrokers. We will only process your personal data in accordance with applicable data protection legislation.

For more information on how we treat your personal data, please review our Privacy Policy.

- Forex Trading Fees Guide: What are Swaps & Spreads?.

- What Is a Spread in Forex Trading?.

- forex inkasso.

- strategy studio trading.

Sign up to our newsletter in order to receive our exclusive bonus offers and regular updates via email. Last update: 12 May On this page, you can learn: What a spread is in forex, and how to calculate it The different types of spreads you may come across, and the benefits of each What a swap is in forex trading The pros and cons of swap fees How to locate swap fees within MetaTrader 4. Brigo, D. International Journal of Theoretical and Applied Finance, 12 07 , Longstaff, and Ravit E.

The Journal of Business 79, no. Related Articles.

Benefit from the best forex demo accounts in Forex demo accounts are one of the most important tools you can have in your trading arsenal. This is because, wh Enter or Exit a Forex Trade. Was the information useful? Don't miss out on great trading opportunities Check HF Markets now to start benefiting today.

Wide range of tradable assets Highly attractive spreads Regulated by trusted institutions Best broker for traders looking to diversify their portfolio Get started. Get the latest Forex updates now! I would like to subscribe to the TopRatedForexBrokers newsletter and hereby give my consent to receive exclusive bonus offers and regular updates via email.

By clicking the "Enter" button, you agree for your personal data provided via live chat to be processed by Trading Point of Financial Instruments Limited, as per the Company's Privacy Policy , which serves the purpose of you receiving assistance from our Customer Support Department. If you do not give your consent to the above, you may alternatively contact us via the Members Area or at support xm. All incoming and outgoing telephone conversations, as well as other electronic communications including chat messages or emails between you and us will be recorded and stored for quality monitoring, training and regulatory purposes.

Please enter your contact information.

What is Swap in Forex? | FX Swap Definition & Strategy

If you already have an XM account, please state your account ID so that our support team can provide you with the best service possible. Open an Account Here. Contact Us. Volume in Lots. Swap Long. Swap Short. Current Conversion Price. Swap Long Account Base Currency. Swap Short Account Base Currency.

Navigation menu

Swap Long Converted Currency. Swap Short Converted Currency. How it works:.

This website uses cookies. Your cookie settings. What are Cookies?

Why are cookies useful? Change Settings. Functional cookies These cookies are essential for the running of our website. Without these cookies our websites would not function properly. Swaps are used to hedge currency exposure, speculate on the direction of a currency and increasingly for access to foreign currency funding. A common reason to employ a currency swap, whose duration ranges from one day to several months, is to secure cheaper debt.

Factbox: FX swaps step from market obscurity to global stage

But in the past few years average swap duration has shortened, often to between one and seven days. Currency swaps were originally conceived in the s to circumvent foreign exchange controls in Britain as at that time UK companies had to pay a premium to borrow in U. Years later, as banks reduced their direct cash lending during the financial crisis, the Federal Reserve allowed several countries facing liquidity problems to borrow via a currency swap, resulting in a widening in the basis for most major currencies against the U.

But throughout the first half of , the basis tightened, reducing the cost of switching between euro and U. That appears to have been a blip in the overall trend, and the basis has since widened. Business News Updated.