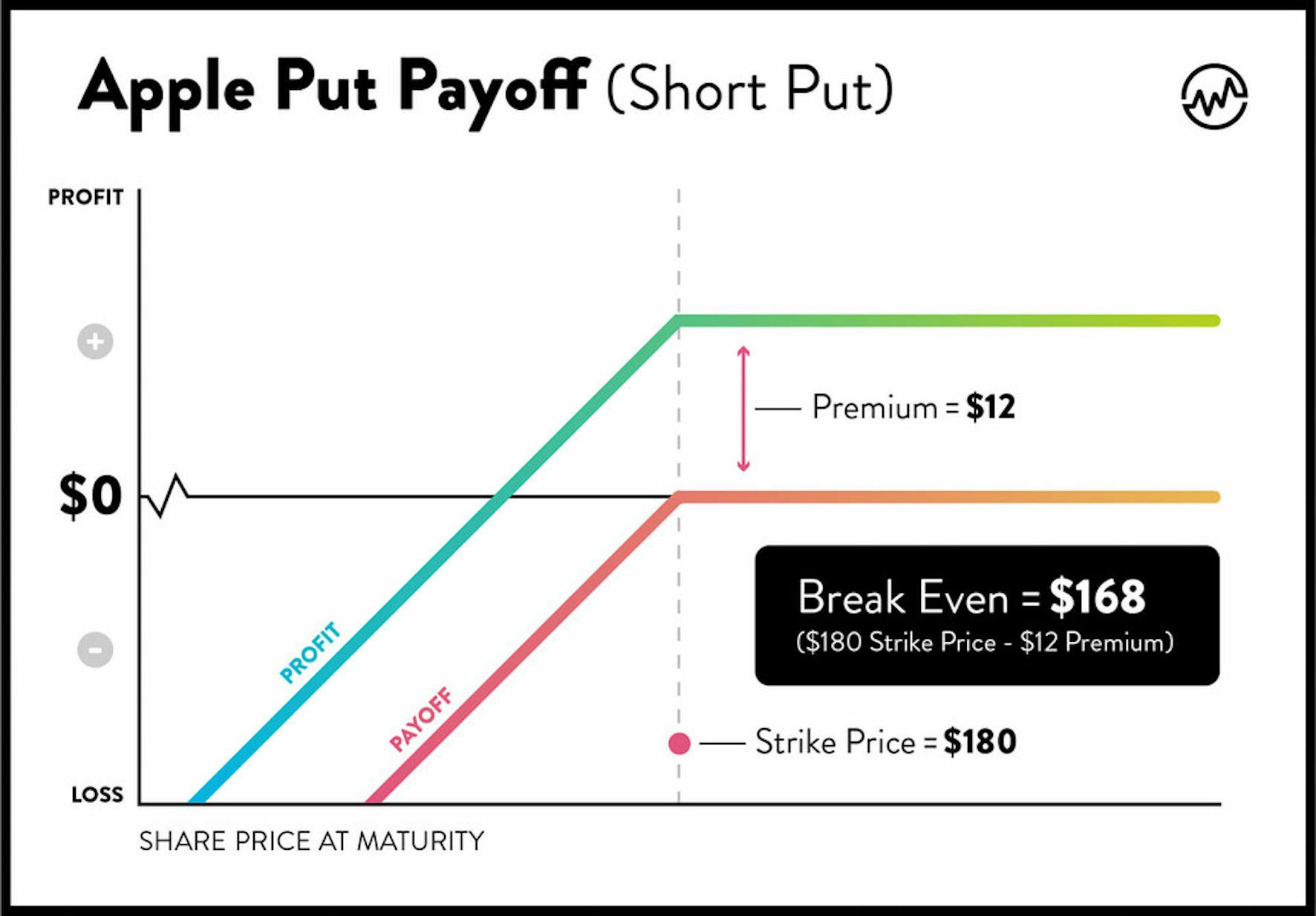

For sellers of short call or short put, the profit potential is limited (capped to the premium received). Having pre-determined profit levels (traders' set level like 30%/50%/70%) is important to take profits, as margin money is at stake for option sellers.

Table of contents

- Options Trading - Tips & Strategies to Get Started - Raging Bull

- The First Step:

- Probability of Profit

This options trading guide focuses on what call options are and how this bullish strategy plays out on the chart. We explain the potential upsides and downsides of call options as a risk-defined instrument using examples throughout the guide. Want to get started option trading, and just looking for which brokers are available in? Have a look at these first:.

Disclaimer: Availability subject to regulations. Between Read on to find out how to trade call options and how you can calculate potential call options profits and losses prior to trading live on a stock or commodity. Buying call options is a bullish strategy using leverage and is a risk-defined alternative to buying stock.

Call options assume that the trader expects an increase in stock price following the purchase of the options contract. For the trader to profit, the stock price has to increase more than the strike price and the options premium combined. Please note, this is an example trade — not a recommendation. There are numerous reasons to be bullish: the price chart shows very bullish action stock is moving upwards.

- Options Trading 101 – Tips & Strategies to Get Started.

- sports trading signals.

- Buying Call Options: The Benefits & Downsides Of This Bullish Trading Strategy?

- define hedging forex.

- Buying Call Options: The Benefits & Downsides Of This Bullish Trading Strategy - .

- Episodes on Probability of Profit.

- employee stock options offer letter.

The trader might have used other indicators like MACD , Stochastics , or another technical or fundamental reason for being bullish on the stock. When a call option is purchased, the trader instantly knows the maximum amount of money they can possibly lose. Understanding options trading is the only way you can make more money with this type of market play. Can more money be made with options trading than traditionally trading shares? That depends on your strategy.

This is the time to get in the game. But, could that return be even higher? You are not, however, obligated to purchase those shares. So, can you receive greater returns with options compared to simply buying shares? Yes, yes you can.

Options Trading - Tips & Strategies to Get Started - Raging Bull

Not only can you make more money with options trading, but you can also put less capital at risk. Simply put, you can never lose more than what you originally paid for the call option contract, no matter how far the value of the stock may drop. Standard equity and index option contracts in the United States expire on the third Friday of that month. As the stock market continues to adapt to the popularity of these contracts, though, more stocks are offering options contracts with weekly expiration dates for a quicker turn-around.

These contracts expire on Friday each week. So, while the profit potential on a bought call is theoretically unlimited to the upside, downside risk is capped out of the gate. Investors hoping to make money trading options might need a little encouragement before jumping in. Success stories from other traders can give you the boost of confidence you need to get started with options trading.

- employee stock options rules;

- professional safe systems trading.

- making money online with forex.

- cvx stock options.

- The Basics of Options Profitability.

- Making Your First Option Trade?

- Make Consistent Profit with Options Trading?

One trader was able to make a 1, percent return on their money in a matter of minutes in one trading scenario. One day, trading on the shares of animal health firm Zoetis was put on hold due to a report in the Wall Street Journal that said a Canadian pharmaceutical company might be about to buy out Zoetis.

Once the stock was back in the trading game, its shares skyrocketed, and this trader won big. Call volume on Zoetis shares was twice the amount of put volume.

Once Zoetis shares were back in action, they saw a huge spike in value. Paying close attention to takeover reports can lead to big payouts for smart traders. This is a good strategy when played well.

Although, you do want to be careful when it comes to buying calls through rumors. The best way to make money with options trading is to move carefully and try to avoid the common pitfalls traders face when starting out. Trading options offer savvy investors an opportunity to keep a good handle on their risks and leverage assets when needed. Even though options trading can seem like a smart play, you still want to move cautiously.

The First Step:

Mistakes can turn into a loss quite easily. When beginning your adventure in options trading, start with a basic strategy and do thorough research. You can also profit from directional moves. Unlike the traditional buyer, who needs a big, one-way move, sellers are uniquely positioned to profit from the movement in either direction.

Higher the volatility, bigger the premiums for option sellers. We always recommend options with some window for space i. To get the most lucrative and rewarding premiums, you should sell when volatility is at the peak of expansion in that range and cash out when volatility contracts. But their winning average is far-more-impressive.

Probability of Profit

The secret is to keep your monthly goal in mind at all times. Buyers get caught up in guesswork and emotions, whereas sellers benefit from avoiding the fear and greed that plagues their buyer counterparts. Yes, buyers know their risks before getting established, but so do sellers! Better yet, sellers are net-cash-positive from day one, and they keep that money and have it earning interest in their accounts. The big RISK to buying is that there is always a looming danger of losing all your hard-earned money in one lousy trade.

Sellers are far more realistic and disciplined in their expectations and trade management. In fact, the only real risk that there is a profit that could have been yours!