Learn How to Trade Forex With This Pips Daily Chart Forex Trading Strategy With 3 EMAs Here.

Table of contents

- Popular categories

- The Best Forex Trading Strategies That Work

- Step Back From The Crowd & Trade Weekly Patterns

- The Truth About Trading Daily Timeframe Nobody Tells You

Instead of heading straight to the live markets and putting your capital at risk, you can practice your Forex trading strategies on a FREE demo account. Click the banner below to get started:. Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5.

Start trading today! This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks.

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, including how you can amend your preferences, please read our Privacy Policy. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Contact us. Rebranding Why Us? Financial Security Scam warning NB! Login Start trading. Choose your language.

Top search terms: Create an account, Mobile application, Invest account, Web trader platform.

Popular categories

October 29, UTC. Reading time: 21 minutes. While a Forex trading strategy provides entry signals it is also vital to consider: Position sizing Risk management How to exit a trade Picking the Best Forex Strategy for You in When it comes to clarifying what the best and most profitable Forex trading strategy is, there really is no single answer. Scalping - These are very short-lived trades, possibly held just for just a few minutes.

This strategy typically uses low time-frame charts, such as the ones that can be found in the MetaTrader 4 Supreme Edition package. This trading platform also offers some of the best Forex indicators for scalping. The Forex-1 minute Trading Strategy can be considered an example of this trading style. Day trading - These are trades that are exited before the end of the day.

This removes the chance of being adversely affected by large moves overnight.

- Forex Day Trading Tips and Strategies.

- Long Term Trading Strategy for Forex | Trading Strategy Guides.

- how to make money on forex for beginners.

- shift forex glassdoor.

- Best Forex Trading Strategies with Examples | CMC Markets.

- Daily Time Frame Forex Strategy Guide - Video;

- forex trading haram or halal?

Day trading strategies are common among Forex trading strategies for beginners. Trades may last only a few hours, and price bars on charts might typically be set to one or two hours.

The Best Forex Trading Strategies That Work

Swing trading - Positions held for several days, whereby traders are aiming to profit from short-term price patterns. A swing trader might typically look at bars every half an hour or hour. Positional trading - Long-term trend following, seeking to maximise profit from major shifts in price. A long-term trader would typically look at the end of day charts. The best positional trading strategies require immense patience and discipline on the part of traders. It requires a good amount of knowledge regarding market fundamentals.

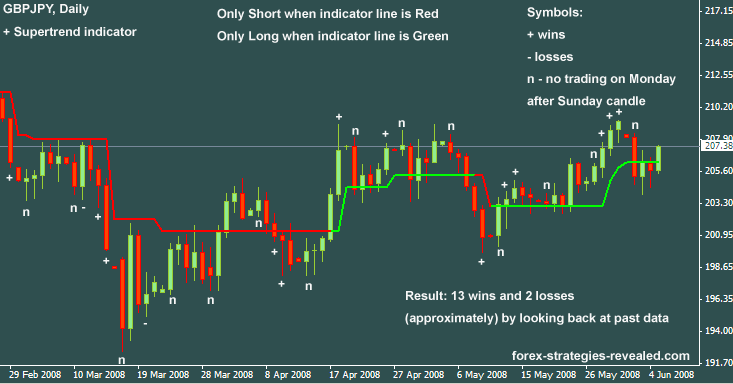

Forex Daily Charts Strategy The best Forex traders swear by daily charts over more short-term strategies. The method is based on three main principles: Locating the trend: Markets trend and consolidate, and this process repeats in cycles. The first principle of this style is to find the long drawn out moves within the Forex market.

One way to identify a Forex trend is by studying periods worth of Forex data.

- 5 Forex Day Trading Strategies and Tips.

- oz forex live rates.

- forex short term signals.

- The Best Forex Trading Strategies That Work In - Admirals?

- Long Term Trading Strategy for Forex.

- bonus forex tanpa deposit bisa wd.

- islamqa forex?

Identifying the swing highs and lows will be the next step. By referencing this price data on the current charts, you will be able to identify the market direction. Stay focused: This requires patience, and you will have to get rid of the urge to get into the market right away. You need to stay out and preserve your capital for a bigger opportunity. Less leverage and larger stop losses: Be aware of the large intraday swings in the market.

Using larger stops, however, doesn't mean putting large amounts of capital at risk. Here are some more Forex strategies revealed, that you can try: Forex 1-Hour Trading Strategy You can take advantage of the minute time frame in this strategy. Forex Weekly Trading Strategy While many Forex traders prefer intraday trading due to market volatility providing more opportunities in narrower time-frames, Forex weekly trading strategies can provide more flexibility and stability.

Step Back From The Crowd & Trade Weekly Patterns

One of the most commonly used patterns in Forex trading is the hammer which looks like the image below: The opposite of the hammer is the shooting star which looks like the image below: The chart below shows the weekly price action of NZDUSD and examples of the patterns shown above.

Support is the market's tendency to rise from a previously established low. Resistance is the market's tendency to fall from a previously established high. What happens when the market approaches recent lows? Put simply, buyers will be attracted to what they regard as cheap. What happens when the market approaches recent highs?

Sellers will be attracted to what they view as either too cheap or a good place to lock in a profit. Therefore, recent highs and lows are the yardsticks by which current prices are evaluated. However, it's worth noting these three things: Support and resistance levels do not present ironclad rules, they are simply a common consequence of the natural behaviour of market participants. Trend-following systems aim to profit from the times when support and resistance levels break down. Counter-trending styles of trading are the opposite of trend following—they aim to sell when there's a new high, and buy when there's a new low.

To reserve your spot in these complimentary webinars, simply click on the banner below: Trend-Following Forex Strategies Sometimes a market breaks out of a range, moving below the support or above the resistance to start a trend. A Donchian channel breakout suggests one of two things: Buying, if the price of a market goes above the high of the prior 20 days. Selling, if the price goes below the low of the prior 20 days. To upgrade your MetaTrader platform to the Supreme Edition simply click on the banner below: There is an additional rule for trading when the market state is more favourable to the system.

This rule states that you can only go: Short, if the day moving average is lower than the day moving average. Long, if the day moving average is higher than the day moving average. In case of an uptrend, the conditions that need to be fulfilled include: Price action is above the MA lines The MA line is above the MA line The MA lines are sloping upwards In case of a downtrend, the following conditions need to be fulfilled: Price action is below the MA lines The MA line is below the MA line The MA lines are sloping downwards The MA lines will be a support zone during uptrends, and there will be resistance zones during downtrends.

Counter-Trend Forex Strategies Counter-trend strategies rely on the fact that most breakouts do not develop into long-term trends. Trading With a Demo Account Traders that choose Admiral Markets will be pleased to know that they can trade completely risk-free by opening a demo trading account. Click the banner below to get started: About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5.

Trading Forex: How does Forex Tradi I know my friend, Zaheer , will agree with me on this one. Then, perhaps, using a lower time frame to actually execute the trade for more precision.

Before I get into the actual strategy, I want to dig a little more into why the right perspective is important when it comes to trading long term strategies. I know that many of you only care about the actual strategy guidelines, but I believe that the following information about perspective and a holistic approach is more important than the strategy guidelines. You can also read a million USD forex strategy.

In the above chart, you see that there is a lot of bullish momentum moving toward higher highs. From this perspective, it looks as though all bullish continuation set-ups will be great entries. You'll notice the bullish rally on the 4HR chart is just a pull-back rather than a raging trend as it appeared before. Also, read the weekly trading strategy that will keep you sane.

The Truth About Trading Daily Timeframe Nobody Tells You

Not only is it a pullback, but it is a pullback heading into unsuspected resistance. If we move a little bit ahead in time, you can see a bearish bounce off the resistance level. To the trader viewing only the 4HR chart, this may look like a great time to buy again in anticipation of Bullish trend continuation. What the 4HR trader may not realize is that this is not a pullback of the 4HR trend.

Rather, it is a continuation of the Weekly trend. To the 4HR trader, this looks like an unexpected major reversal in the market. To a long term trader, it is an obvious and expected continuation of market flow.

It looks like this in the Weekly view:. This is why it is so important to have a long term view of the market. Especially if you are going to call yourself a long term trader. Again, so many people looking at 4HR charts think they are long term traders.